ALTERATIONS

Alterations to Policy

After the policy is purchased, there may be discrepancies that you wish to correct. These discrepancies can be called alterations.

After purchase, any policyholder can request modifications to LIC policies. Insurance companies often have guidelines that you must follow.

The policyholder might decide that a policy is not suitable for him/her due to multiple reasons. In these cases, he/she may want to modify or alter the policy. LIC covers many types of policy alterations. However, any request for modification made within the first year after the purchase of the policy is not accepted.

Types of Alterations under the LIC Policy

• Modification in class

• Modification in term

• Reduce the amount of the sum assured

• Modification of the premium payment method

• Addition of premium

• Change from a plan without profit to a plan with a profit

• Modification of the name of the policyholder

• Corrections in the holding policies

• Option to settle sum assured by installments

• Accident benefits grant

• Premium waiver benefit

• Change of currency and payment place

What documents are required for policy modification?

In the event of a policy change, you may need to provide supporting documentation:

• Let us know why you feel the policy needs to be changed.

• Receipt and quotation fee

• The original copy of the LIC policy document -

• Declaration of Health (only when requested)

What are some other policy alteration conditions?

To get a better idea of the scope of LIC policy alterations, you can also look at the following:

• In the event of a policy being lost: LIC Servicing Branch: If a policy is lost because of natural causes such as fire, flood, etc. or if it is not traceable due to unknown reasons, the policyholder must contact LIC to request a duplicate. A duplicate policy can usually be obtained in a matter of minutes.

• Changes in residential address: LIC must be notified if the policyholder moves to a new city or a new home. This ensures that the policyholder is aware of any LIC services that may be available at that time. The policyholder might not receive important information such as premium notices or survival benefits on time. LIC usually offers services to change existing addresses, contact information, and email ID.

• If you have to change your age: The premium amount is determined by one's age. It is important to verify your age before purchasing a policy. If there is a discrepancy after purchase, you can send an attested copy to LIC officials.

• Nominees may be included or altered: Nominations are an integral part of the life insurance sector. It is therefore important to include one in an LIC policy. The policyholder can update the section on the nominee at any time during its life. If the policyholder has not yet included any nominees, it is recommended that they do so as soon as possible.

LIC charges a quotation fee, which is a fee that is charged for altering a policy. The procedure is carried out without additional fees.

How FinSukh.com works?

There may be instances when you would like to make alterations in your policy like change of premium payment mode, address, nominee or policy status, loan status and revival of policy etc. Our customer service is considered the best in the business and will handle your request proficiently and promptly.

1. Tell us what you’re looking for

2. We find the best advisor in your area

3. You connect with the local advisor of your area

4. Free Consultation & Guidance on Policy Servicing Matters

5. Handling of all your queries and filing all required forms along with necessary documents

6. Customer or Policyholder need to pay pre fixed administrative and service charges to the advisor

7. Personal visit to respected branch for alteration related work and get it done in required manner

8. Delivery of altered documents at home address once completed

9. Support system for post service queries and difficulties, if any

Expert Calling

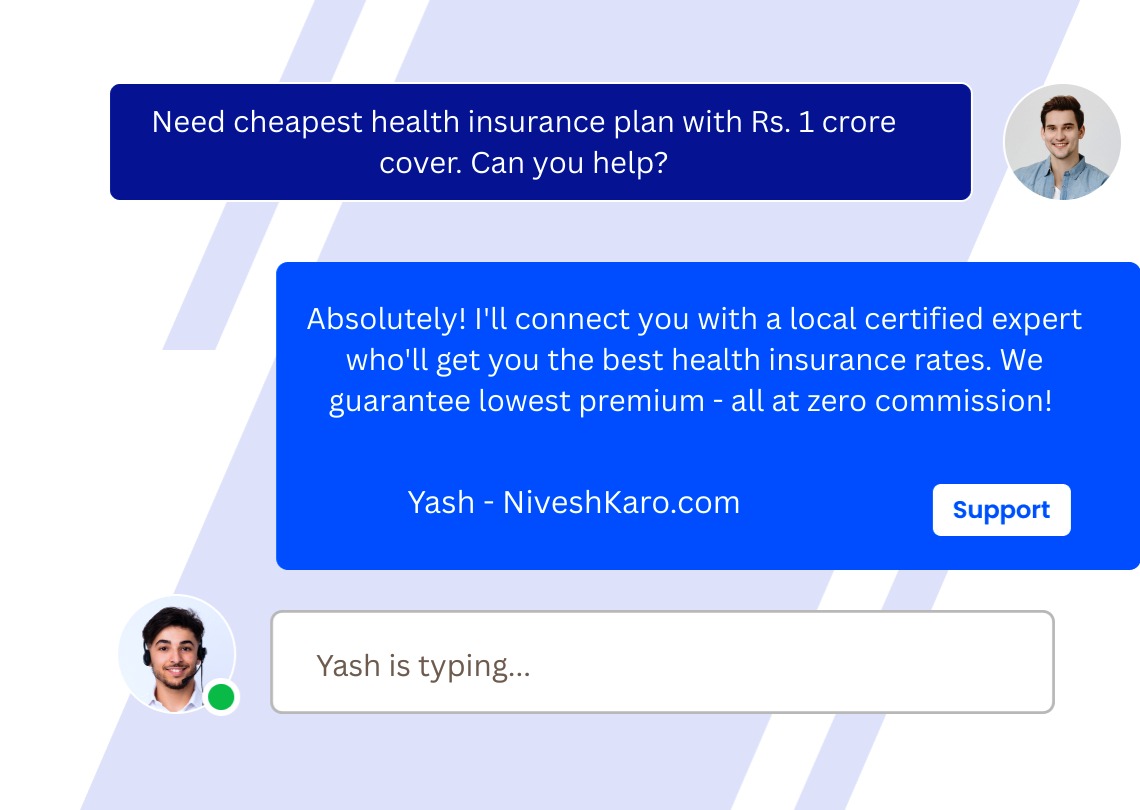

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.