Revival of Policy

Revival of lapsed policies

Your policy will be canceled if you fail to pay premiums by the due date. The policy must be renewed by paying the accrued premiums and interest, as well as fulfilling any health requirements. To ensure your family's financial security, keep your policy current. Exceptions to the claims concession are exempted from this restriction.

Types of revival offered LIC

You can revive lapsed LIC policies by using any one of these options:

• Ordinary revival: LIC's simplest form of revival, called "ordinary revival", is what the name suggests. The payment of the delayed premium amount and the interest fee is all that's required to revive the church. This type of revival can only be initiated within six months of the date of lapsation. In this instance, the company won't require any personal statements regarding the health of the policyholder.

• Revival on a non-medical basis: The sum assured amount that can be restored under this scheme must not exceed the limits of non-medical insurance taken by the insured.

• Revival on a medical foundation: If a policy is not able to be revived using the normal revival or non-medical recovery methods, this type of revival may be used. Based on the amount of the policy to be revived, the company will determine the medical requirements.

• Special revival program: This method allows a policy that has lapsed to be revived by moving the date at which it began. This scheme allows you to move the date up to 2 years. This type of revival is only allowed once per policy term. If this revival method is to begin, it should not be halted for more than 3 years.

• Revival installment scheme: This is a method that is allowed if the policyholder is unable to pay the entire revival amount in one instalment. This scheme is also available if the policy cannot been revived using any of the previously mentioned methods. If the outstanding premiums have been paid for more than one calendar year, this scheme cannot be initiated.

• Loan cum Revival Scheme: This method of revival uses the policy's loan amount. The policyholder must pay the remaining amount if the loan amount does not cover premium arrears. The policyholder will receive any balance after payment of premium arrears.

• Survival benefit cum revival program: This type of revival can be used for money-back policies. The beneficiary's survival benefit can be used to revive the policy. The policyholder must pay any premium arrears that exceed the survival benefit payable.

How to Revive a Policy

The policyholder can pay the interest fees for late payment to revive their policy. The insurer can accept or reject the policy at their discretion, although rejections are rare. The policy benefits are also restored once the policy has been revived.

For LIC policies, you can either contact the agents directly or visit the branch to start the revival process. The process is similar for other insurance companies. To learn more about revival procedures, you can call your insurer's customer service.

It is generally better to keep your policy active and pay premium dues on-time. Insurance companies will usually remind you to pay your premiums by mail, text message, or both.

How FinSukh.com works?

There may be instances when you would like to make alterations in your policy like change of premium payment mode, address, nominee or policy status, loan status and revival of policy etc. Our customer service is considered the best in the business and will handle your request proficiently and promptly.

- Tell us what you’re looking for

- We find the best advisor in your area

- You connect with the local advisor of your area

- Free Consultation & Guidance on Policy Servicing Matters

- Handling of all your queries and filling all required forms along with necessary documents

- Customer or Policyholder need to pay pre fixed administrative and service charges to the advisor

- Personal visit to respected branch for alteration related work and get it done in required manner

- Delivery of altered documents at home address once completed

- Support system for post service queries and difficulties, if any

Expert Calling

Always Available Support

Real-Time Support When

You Need It

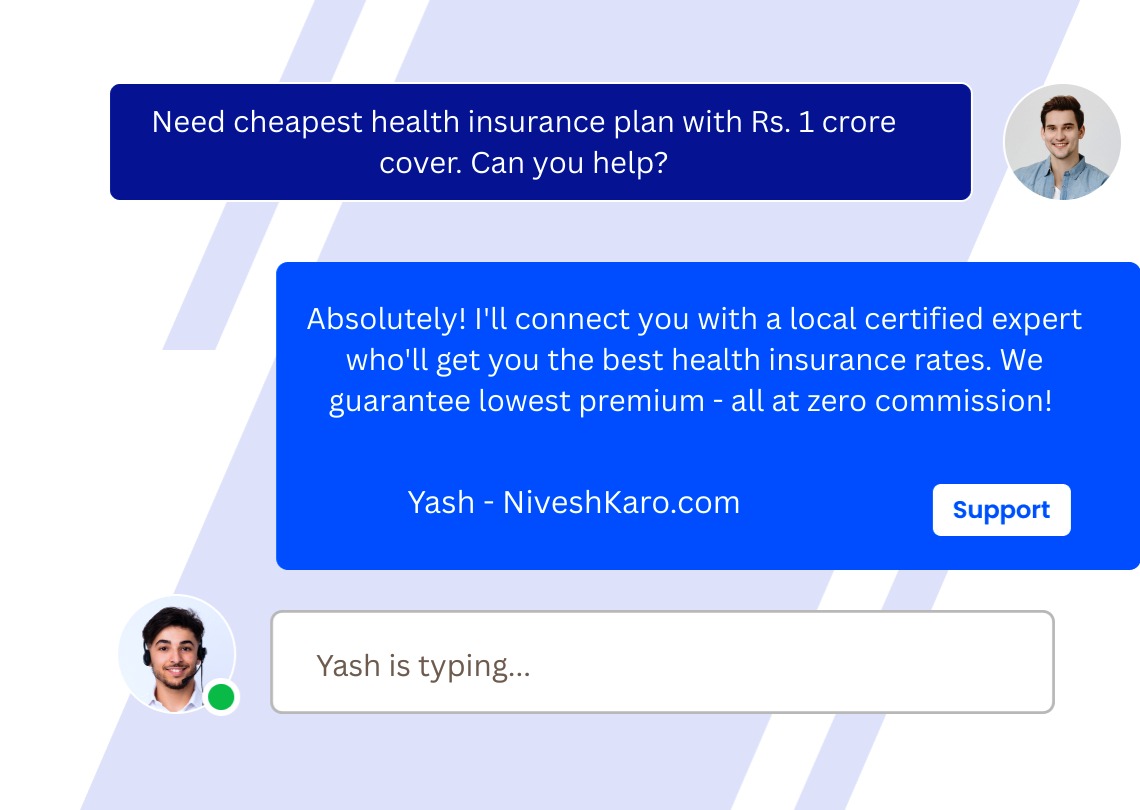

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.