Tata AIG General Insurance

Established in 2001, Tata AIG General Insurance is a joint venture between Tata Group and American International Group (AIG). It currently has 200 offices spread across India, with its headquarter based out of Mumbai. It has received an iAAA rating by ICRA for excellent claims paying ability.

Some interesting add-on benefits provided by this insurance company are daily allowance if your car repair takes longer than usual, engine security, tyre security, and coverage for loss of personal belongings during an accident. It has won the Extraordinaire Award at the 5th Brand Vision Summit 2019-20.

Company Highlights (Key Features & Benefits)

1. Multiple Plan Options

The company is offering multiple car, bike, & commercial vehicle insurance plans to cater to your different needs. You can choose the one that insures your vehicle in unfortunate circumstances.

2. Claim Settlement Ratio

The claim settlement ratio provided by Tata AIG General Insurance in FY20:

Car 98%, Bike 98%, and Commercial Vehicle 98%

3. Network Garages

The company has 7,500+ authorized network garages spread across the country where you can get cashless claim settlement.

4.24*7 Customer Assistance

You can contact them for inquiries or complaints 24x7 and also for claim assistance through SMS, emails, and phone call, seven days a week.

5.No Claim bonus

They transfer the no-claim bonus from previous policy (maximum up to 50%) to you.

6.24*7 Roadside Assistance

Add-on benefit to choose 24x7 emergency roadside assistance, which is just a call or click away no matter where you are stuck in India.

7. Zero Depreciation

Avail unlimited benefits of zero depreciation cover, with add-on benefits.

8. Personal Accident Cover:

For Car - up to Rs. 15 Lakh

For Bike - up to Rs. 15 Lakh

9. Third-Party Coverage:

For Car - Up to Rs. 7.5 Lakh (Property Damage)

For Bike - up to Rs. 1 Lakh (Property Damage)

10. Add on Cover

There are multiple add-on covers like Return to Invoice, Cover for Loss Of Personal Belongings, Consumable Expenses, Tyre Security, Engine Security, Key Replacement, Emergency Transport & Hotel Expenses, Daily Allowance, Free One Repair Claim of Glass, Fibre Plastics and Rubber parts.

Plans:

The Company is offering multiple car, bike, & commercial vehicle insurance plans to cater to your different needs. You can choose the one that insures your vehicle in best way. Plans are as follows:

• Comprehensive car insurance

• Third-party car insurance

• Standalone car insurance

• Standalone car insurance exclusions

• Usage-based motor insurance

Why to buy with FinSukh?

• Instant policy # within few minutes

• Huge Network of Local Advisors

• Lowest Price Guaranteed

• Guaranteed Claim Assistance

• No Commission for matching Advisor

• 24*7 Online Digital Support

How to buy with FinSukh.com

1. Tell us what you’re looking for

2. We find the best agents in your area

3. You connect with the local agents of your area

4. Presentation & Completion of Proposal

5. Delivery of final documents with support till policy term

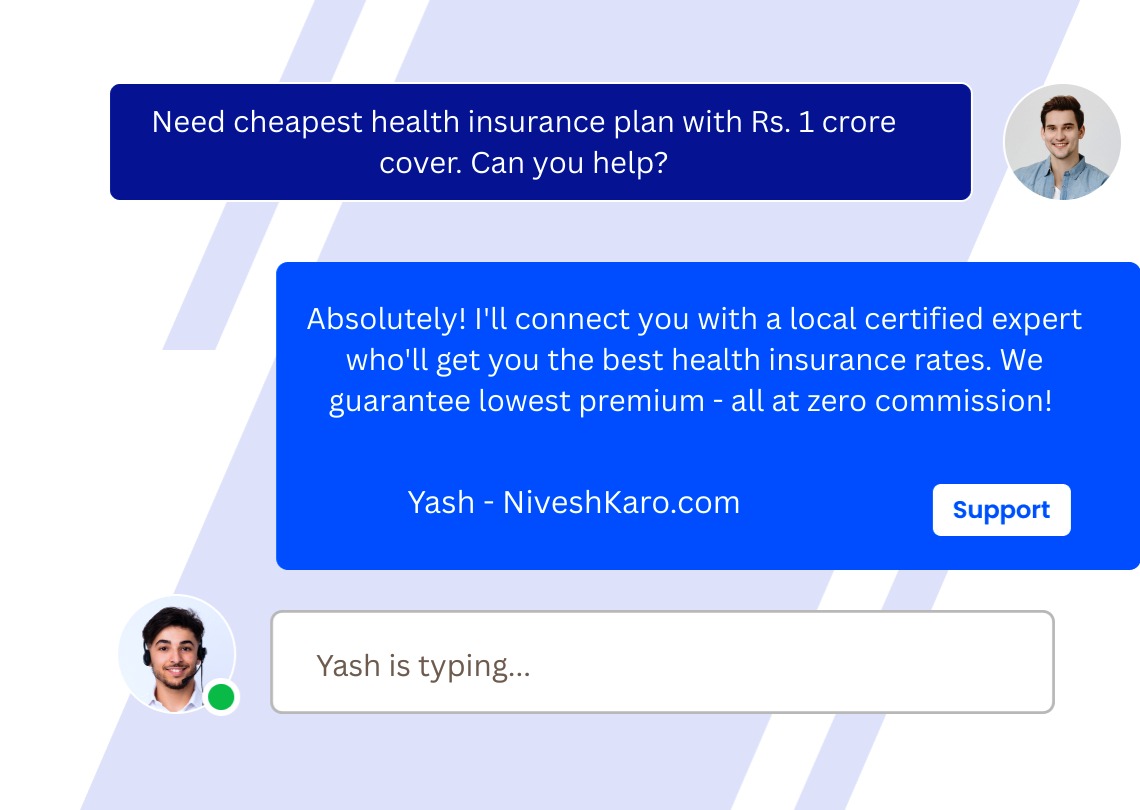

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.