HDFC MUTUAL FUND

HDFC Mutual Fund, India's largest mutual fund manager, has 4.1 trillion assets under management. We were established in 1999 as a joint venture of Standard Life Investments Limited ("SLI") and Housing Development Finance Corporation Limited ("HDFC"), and began operations in 1999. We completed an initial public offering in FY18-19 and were publicly listed in August 2018. The public currently owns 26.1%. HDFC Asset Management Company ("HDFC AMC") manages the investments for the HDFC Mutual Fund ("HDFC MF") schemes.

HDFC Mutual Fund offers a complete suite of savings products and investment products across all asset classes. It provides income and wealth creation opportunities for our large retail and institutional customers of 9.1million live accounts.

HDFC Mutual Fund holds a dominant position when it comes to equity investments. It has the largest market share of actively managed equity-oriented funds and is therefore the most popular. HDFC Mutual Fund's strengths are in providing easy-to-use investment products that can be used by every Indian household. These funds are the best choice for retail investors and have the highest assets market share from individual investors. One in four Indian mutual fund investors has invested in one or more of the HDFC Mutual Fund Schemes. Our ability to offer systematic transactions increases our appeal to individuals who want to invest regularly in a controlled and risk-reducing manner. HDFC Mutual Fund schemes are resilient to market cycles and have a track record of over 25 years. We can expand our reach by working with different distribution partners.

It currently has more than 65 thousand distributors who are national distributors, mutual fund distributors and banks. HDFC Mutual Fund serves our customers and distributor partners in more than 200 cities via our network of 224 branches, and 1163 employees.

The highly stable Management of HDFC Mutual Fund has guided the company through ever-changing industry and since its inception. Our comprehensive investment philosophy, risk management and process have kept HDFC Mutual Fund a top asset management company in India. The 30-member investment team has a proven track record of success, stability, and deep business knowledge. HDFC Mutual Fund provides portfolio management and segregated accounts services to high net-worth individuals ("HNIs"), families, domestic corporations, trusts, provident fund and other domestic and international institutions.

Assets Managed: Rs. 415566.10 Crore (Mar-31-2021).

How to invest in Mutual Fund via FinSukh.com?

FinSukh.com has made mutual funds investment extremely easy, even for new investors. One can invest in mutual funds by following the 7 steps below:

- Tell us what you’re looking for

- We find the best advisor in your area

- You connect with the local advisor of your area

- Need based Financial Planning & Presentation to identify your financial goals

- Pick the right kind of mutual fund depending on your goals and Decide on your investment amount

- Documentation (KYC), Verification and Completion of Proposal

- Delivery of final documents with support till you reached your goals

KYC Required to Invest in Mutual Fund

Know Your Customer, commonly referred to as KYC, enables banks and financial institutions to verify the identity of their customers. You only need to do this once as a first-time investor. SEBI has prescribed requirements for KYC. An investor has to be KYC compliant while investing in a SEBI registered mutual fund. A KYC form will include identity, address, financial status, occupation, and demographic information.

Why to invest in Mutual Fund with FinSukh.com?

• Instant investment solution within few minutes • Huge Network of Local Advisors • Lowest Price Guaranteed

• Guaranteed Claim Assistance • No Commission for matching Advisor • 24*7 Online Digital Support

Just give us your name, phone number, and email address. We'll help you get started in minutes!

Expert Calling

Always Available Support

Real-Time Support When

You Need It

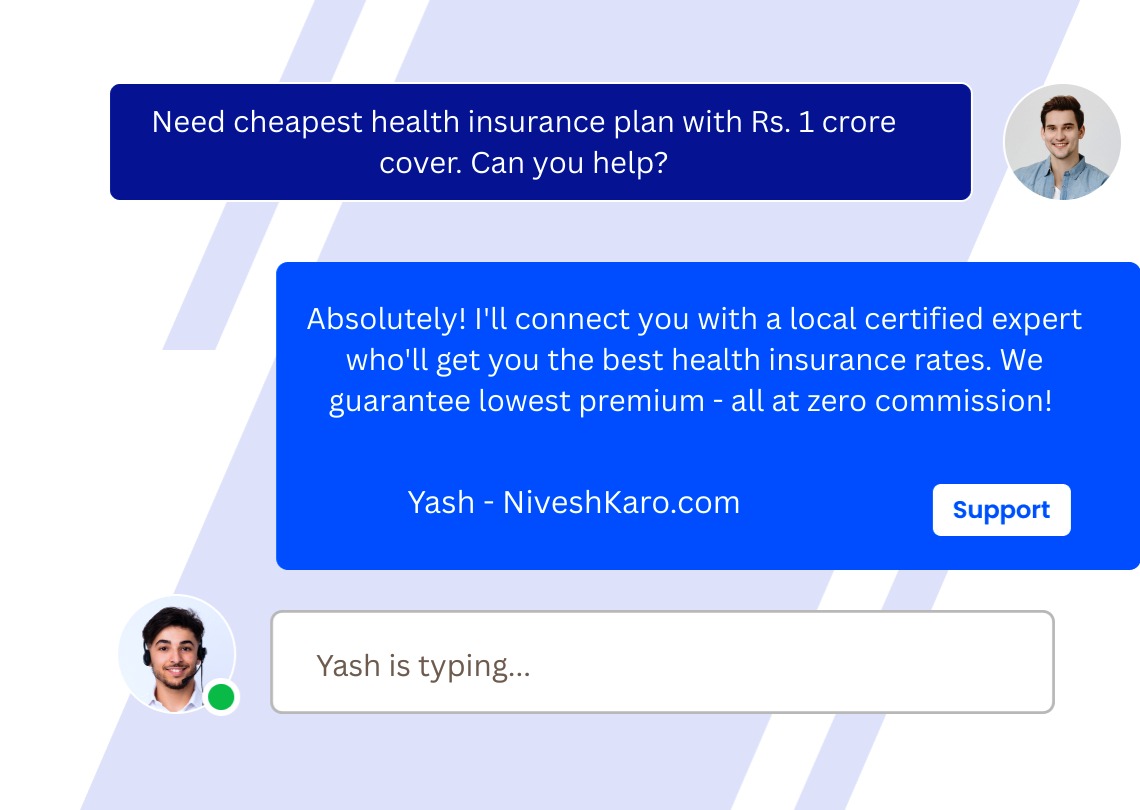

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.