Senior Citizen Saving Scheme

Senior Citizens Saving Scheme

Senior Citizens Saving Scheme, or SCSS, is a government-backed savings retirement benefits program for seniors over the age of 60. Individuals between 55 and 60 years old who have chosen Voluntary Retirement Scheme may also invest in SCSS. Senior citizens can make a minimum of Rs 1000 and invest up to Rs 15 Lakh in Senior Citizen Savings Scheme.

The Senior Citizen Savings Scheme

• An account must be opened with a minimum deposit equal to one thousand rupees.

• After the five-year maturity period, the depositor can extend the account for an additional three years.

• These rules stipulate that deposits made in accordance with these rules will bear interest at the rate set by Govt of India, which is usually quarterly. It is currently 7.40% per year, effective 01.04.2020.

• An account holder who does not claim the quarterly interest will not be entitled to any additional interest.

• The entire amount of deposit in a joint bank account must be credited to the account holder who made it.

• Both spouses can open a single account or joint accounts.

• The depositor can nominate one or more people.

• The depositor may cancel or modify any nominated funds.

• The account deposit must be paid within five years of its opening or eight years if the account has been extended beyond that date.

• Multiple withdrawals from a single account are not allowed.

• Premature payment Permitted after account opening, but subject to penalty

• TDS is deducted from Interest when it exceeds INR 50000

Eligibility

• A person can open an account either in their own capacity or with a spouse.

• These rules do not apply to NRI's and Hindu Undivided Families.

• A person who is 60 years old or older.

• Who has reached the age of 55 or more, but less than 60 and has retired from superannuation or other means on the date they opened an account.

• Retired personnel from the Defence Services reach fifty years old.

Documents Requirement For SCSS

Investors will need to submit a copy with self-attestation of the following documents.

• Identification Proof: Passport, Aadhar, PAN card etc.

• Address proof: Phone bill, Aadhar card or PAN card.

• You must have a passport, senior citizen card, a birth certificate issued by the Corporation, Registrar of Births and Deaths or Voter ID card, etc. to prove your age.

• Photographs of passport size.

How to invest in Investment Schemes via FinSukh.com?

FinSukh.com has made investment extremely easy, even for new investors. One can invest in various investment schemes by following the 7 steps below:

1. Tell us what you’re looking for

2. We find the best advisor or source in your area

3. You connect with the local advisor of your area

4. Need based Financial Planning & Presentation to identify your financial goals

5. Free guidance to pick the right kind of schemes depending on your goals

6. Guidance on Documentation (KYC), Verification and Completion of Proposal

7. Support system for post investment queries and difficulties, if any

KYC Required to Invest in Investment schemes

Know Your Customer, commonly referred to as KYC, enables banks and financial institutions to verify the identity of their customers. You only need to do this once as a first-time investor. A KYC form will include identity, address, financial status, occupation, and demographic information.

Why to invest in Investment Schemes with FinSukh.com?

• Instant investment solution within few minutes • Huge Network of Local Advisors • Lowest Price Guaranteed

• Guaranteed Claim Assistance • No Commission for matching Advisor • 24*7 Online Digital Support

Just fill our enquiry form or give us your name, phone number, and email address. We'll help you get started in minutes!

NOTE: As this is a Govt. of India scheme, customers are advised to visit National Savings Institute website www.nsiindia.gov.in for latest instructions/ modification in the scheme.

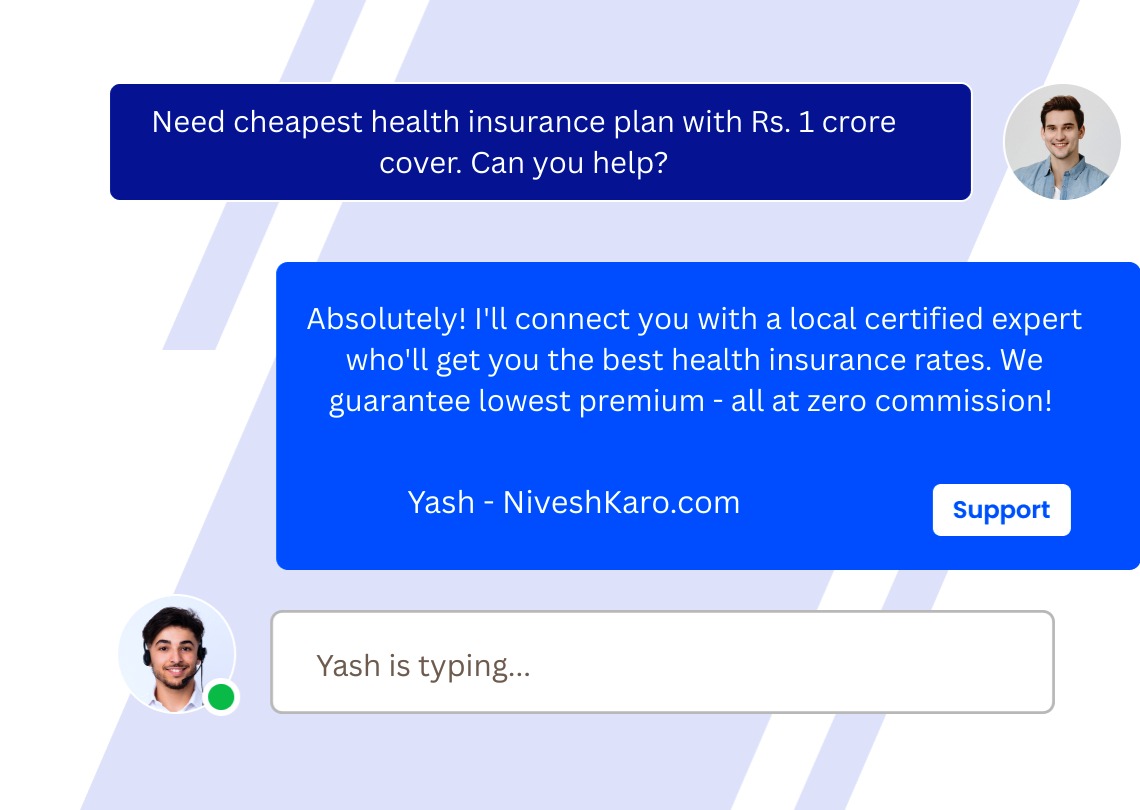

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.