National Pension System (NPS)

National Pension System (NPS), a voluntary retirement savings plan, allows subscribers to make a defined contribution towards planned savings and secure their future through pension. It is an attempt to find a sustainable solution for the problem of providing sufficient retirement income to all citizens of India.

Subscribers may use their pension wealth to purchase annuities from a PFRDA-empanelled life insurance company at the time of normal exit from NPS. They can also withdraw a portion of the accumulated retirement wealth as lump sum. PFRDA is responsible for the implementation and monitoring NPS.

NPS Scheme features

• Tier I – Pension account (Mandatory A/C- Tax benefit available).

• Tier II – Investment account (Optional C/C - No tax benefits but corpus can be withdrawn anytime) Rs. In a Financial Year, Rs. 50,000

• For Tier I, the minimum contribution during A/C openings is Rs.500

• Tier II: Minimum contribution during A/C opening Rs.1,000

• Min. Rs.1,000 annual minimum contribution Minimum annual contribution of Rs.1,000 (Minimum). Tier I: Contribution amount Rs.500

• N.A. Minimum annual total contribution (Minimum contribution Rs.250) Tier II: Minimum total contribution in a year N.A. (Minimum contribution Rs.250 for Tier II

• This product is very affordable with Fund Management charges of 0.01%.

Under the All Citizen Model, who can open a NPS Account?

• Indian citizens, resident or not, are subject to these conditions:

• The applicant must be aged between 18 and 65 years as of the submission date. They should also comply with KYC norms.

NPS Account Benefits

i) Low cost:- NPS is the most affordable pension scheme in the world. The administrative charges and the fund management fee are also low.

ii) Simple: To open an account at any of the POPs run by all Head Posts Offices in India and receive a Permanent Retirement Account Number (PRAN), applicants must do one thing:

iii) Flexible: To get better returns, applicant can select their own investment option, Pension Fund or Auto Choice.

iv) Portable: The applicant can open an account anywhere in the country. He/she can also pay contributions through any POP-SP branch, regardless of where he/she is registered. If the subscriber is employed, the account can be transferred to another sector such as Government Sector or Corporate Model.

How to invest in Investment Schemes via FinSukh.com?

FinSukh.com has made investment extremely easy, even for new investors. One can invest in various investment schemes by following the 7 steps below:

1. Tell us what you’re looking for

2. We find the best advisor or source in your area

3. You connect with the local advisor of your area

4. Need based Financial Planning & Presentation to identify your financial goals

5. Free guidance to pick the right kind of schemes depending on your goals

6. Guidance on Documentation (KYC), Verification and Completion of Proposal

7. Support system for post investment queries and difficulties, if any

KYC Required to Invest in Investment schemes

Know Your Customer, commonly referred to as KYC, enables banks and financial institutions to verify the identity of their customers. You only need to do this once as a first-time investor. A KYC form will include identity, address, financial status, occupation, and demographic information.

Why to invest in Investment Schemes with FinSukh.com?

• Instant investment solution within few minutes • Huge Network of Local Advisors • Lowest Price Guaranteed

• Guaranteed Claim Assistance • No Commission for matching Advisor • 24*7 Online Digital Support

Just fill our enquiry form or give us your name, phone number, and email address. We'll help you get started in minutes!

NOTE: As this is a Govt. of India scheme, customers are advised to visit National Savings Institute website www.nsiindia.gov.in for latest instructions/ modification in the scheme.

Expert Calling

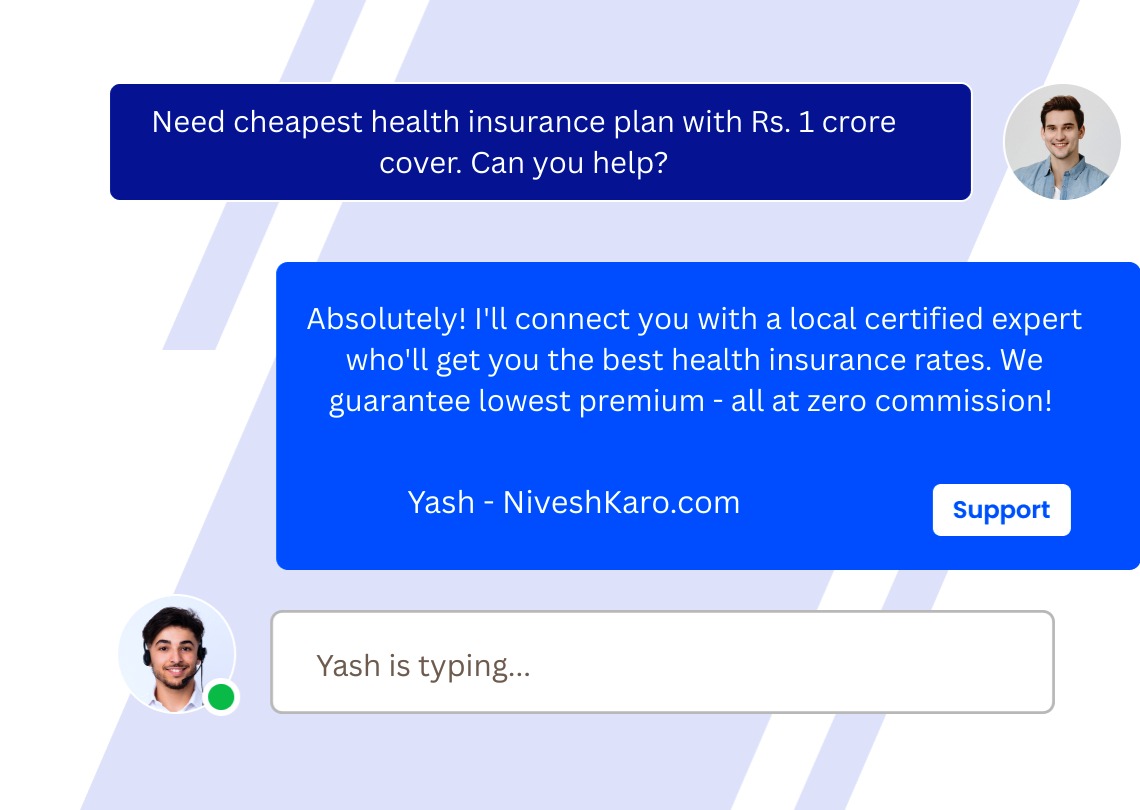

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.