Pradhan Mantri jan Dhan Yojana

Pradhan Mantri jan Dhan Yojana

The "Pradhan Mantri Jan-Dhan Yojana" (PMJDY), was initially launched under the National Mission for Financial Inclusion for a period 4 years. It was launched in two phases on 28 August 2014. It aims to provide universal banking access with at least one basic account per household. Financial literacy is also included.

PMJDY provides a platform for three social security programs viz. Pradhan Mantri Jeevan Jyoti Yojana, Pradhan Mantri Suraksha Yojana, Atal Pension Yojana and Pradhan Mantri Mudra Yojana are all part of PMJJBY.

The Government has extended the comprehensive PMJDY program beyond 28.8.2018. With a shift in focus to opening accounts for "every household" instead of "every adult", the following modifications were made:

(I) Limit of Rs. 5,000 revised to Rs. 10,000

(iii) There are no conditions for PMJDY accounts that have OD of up to Rs. 2,000

(iii). Age limit to avail OD facility has been changed from 18-60 years old to 18-65.

(iv) Increased accidental insurance coverage for RuPay card holders from Rs.1 lakh to R. 2 lakh for new PMJDY accounts after 28.8.2018

Information about the Scheme

Pradhan Mantri Jan Dhan Yojana (PMJDY) is a National Mission for Financial Inclusion that provides affordable access to basic savings and deposit accounts, remittances, credit, insurance, and pension. A basic savings bank deposit account (BSBD), can be opened at any branch of any bank or Business Correspondent outlet (Bank Mitra), by anyone who does not have any other account.

Benefits of PMJDY

• Unbanked persons can open a basic savings account.

• There is no minimum balance requirement in PMJDY accounts.

• Deposits in PMJDY accounts earn interest.

• PMJDY account holders are eligible for Rupay Debit cards.

• Accident insurance coverage of Rs.1Lakh (enhanced up to Rs. 2Lakh to RuPay card is issued to PMJDY account holders and allows for 2 lakh to new PMJDY Accounts.

• A facility for overdrafts (OD) up to Rs.10000 Available to account holders who are eligible.

• PMJDY accounts can be eligible for Direct Benefit Transfers (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana [APY], Micro Units Development & Refinance Agency Bank scheme (MUDRA).

How to invest in Investment Schemes via FinSukh.com?

FinSukh.com has made investment extremely easy, even for new investors. One can invest in various investment schemes by following the 7 steps below:

1. Tell us what you’re looking for

2. We find the best advisor or source in your area

3. You connect with the local advisor of your area

4. Need based Financial Planning & Presentation to identify your financial goals

5. Free guidance to pick the right kind of schemes depending on your goals

6. Guidance on Documentation (KYC), Verification and Completion of Proposal

7. Support system for post investment queries and difficulties, if any

KYC Required to Invest in Investment schemes

Know Your Customer, commonly referred to as KYC, enables banks and financial institutions to verify the identity of their customers. You only need to do this once as a first-time investor. A KYC form will include identity, address, financial status, occupation, and demographic information.

Why to invest in Investment Schemes with FinSukh.com?

• Instant investment solution within few minutes • Huge Network of Local Advisors • Lowest Price Guaranteed

• Guaranteed Claim Assistance • No Commission for matching Advisor • 24*7 Online Digital Support

Just fill our enquiry form or give us your name, phone number, and email address. We'll help you get started in minutes!

NOTE: As this is a Govt. of India scheme, customers are advised to visit National Savings Institute website www.nsiindia.gov.in for latest instructions/ modification in the scheme.

Expert Calling

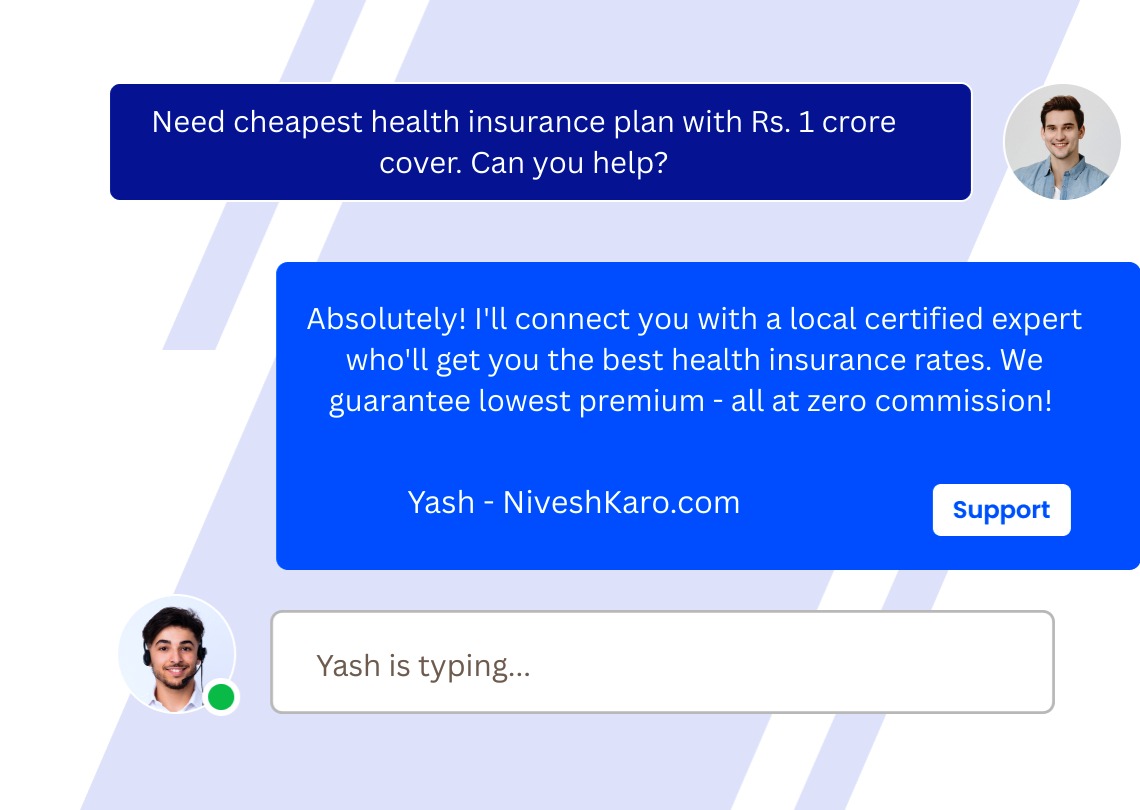

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.