JEEVAN LABH PLAN 736

About Jeevan Labh Plan 736

LIC Jeevan Labh 736 is a unique limited premium endowment plan—a powerhouse of savings and life protection in one. Designed for people who want guaranteed wealth creation, lifelong security, and fewer years of premium payments, Jeevan Labh stands out for its simplicity and effectiveness. Whether saving for a child’s future, marriage, or simply wanting long-term peace of mind, this plan is an ideal fit.

Why Jeevan Labh Is an Indian Favorite

• Limited Premiums: Pay for 10, 15, or 16 years, but enjoy full coverage till 16, 21, or 25 years.

• Flexible Term Choices: Suits early planners and mid-career earners aiming for milestone-based returns.

• Endowment Advantage: Guaranteed maturity or death benefit—with bonuses, not market-linked.

Key Features & Plan Structure

• Policy Type: With-profit, non-linked endowment; combines insurance with savings.

• Minimum Entry Age: 8 years; Maximum varies (59 years for 16-year term, 54 for 21-year, 50 for 25-year policy).

• Policy Term Options: 16, 21, or 25 years.

• Premium Paying Term: 10, 15, or 16 years (3–10 years less than total policy term).

• Minimum Sum Assured: Rs. 2,00,000; no upper limit (multiples of Rs. 10,000).

• Premium Modes: Yearly, Half-Yearly, Quarterly, or Monthly via ECS.

• Bonuses: Eligible for simple reversionary and final additional bonus during term.

• Loan Facility: Available after 1 full premium—ensure liquidity in emergencies.

• Surrender & Revival: Fast surrender value, revival possible within 5 years from lapse.

How Jeevan Labh 736 Works

1. Pick your policy term and sum assured based on goals—marriage, education, retirement, or wealth creation.

2. Pay premiums for the chosen limited term. Rest easy knowing coverage continues up to the policy’s end.

3. On Survival (Maturity):

o Receive Basic Sum Assured + Accrued Bonuses (annual + possible final additional bonus at maturity).

4. On Death (during policy):

o Nominee gets higher of Basic Sum Assured OR 7x annual premium + all accrued bonuses (minimum 105% of premiums paid).

o Option to receive as lump sum or installments (5, 10, or 15 years).

5. Flexibility: High sum assured rebates, frequency rebates for annual/half-yearly premiums, quick loans available.

Benefits in Action

• Lower Commitment, Greater Rewards: Limited payment years means savings can start sooner elsewhere.

• High Maturity Returns: With annual bonuses and possible final bonus, maturity value is often much higher than the sum assured.

• All-Round Protection: Death benefit, maturity value, liquidity in emergencies.

• Premium Rebates: Additional reductions for higher sum assured and annual/half-yearly payment mode.

• Tax Savings: Premium qualifies for 80C; maturity and death payouts exempt under 10(10D).

• Customization: Choose from extra riders—accident, disability, premium waiver—for enhanced protection.

Eligibility

|

Minimum Entry Age |

8 years |

|

Maximum Age (16-year term) |

59 years |

|

Maximum Age (21-year term) |

54 years |

|

Maximum Age (25-year term) |

50 years |

|

Minimum Sum Assured |

Rs. 2 lakh |

|

Policy Term Options |

16, 21, 25 years |

|

Premium Paying Term |

10, 15, 16 years (depends on policy term) |

Why Pick Jeevan Labh Over Other Plans?

• Pay Less, Get More: Shorter premium term, longer coverage, greater bonus participation.

• Flexible, Hassle-Free: Fast surrender, easy loan, renew lapsed policies in 5 years.

• Suitable for… Salaried, business owners, parents, anyone planning for a major financial milestone.

• No Market Risk: Profits are shared as bonuses, not affected by stock markets.

Common Questions Answered

• Who can buy? Anyone aged 8–50/54/59 years (based on the policy term).

• Can I opt for online purchase? Jeevan Labh is primarily sold offline through verified LIC advisors.

• How quickly can I surrender? After paying a single year’s premium.

• Can I get a loan? Yes—ideal for meeting financial needs without breaking the plan.

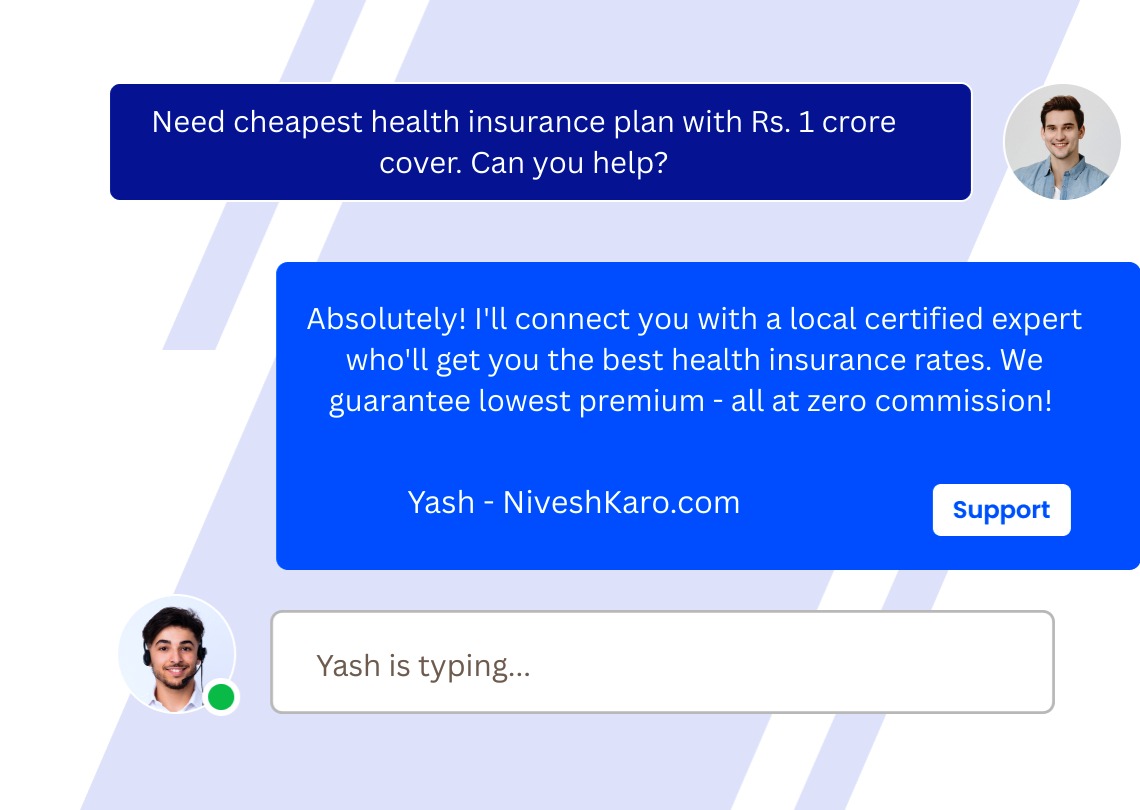

How NiveshKaro.com Helps

• Instantly connects you with a certified, local LIC advisor who explains every benefit and helps tailor Jeevan Labh to your goals.

• Personalized quotes, side-by-side plan comparisons, and claim assistance—all at zero commission.

• Clarity, seamless onboarding, and guidance every step till maturity and claim settlement.

Take decisive action to build wealth and secure your family—choose LIC Jeevan Labh 736 with NiveshKaro for a smart, committed path to guaranteed prosperity and protection.

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.