Understanding Your CIBIL Score: Impact on Loan Approval and Ways to Improve Creditworthiness

Ever felt like your credit score is the silent gatekeeper deciding if your dream home loan gets approved or slips away? It's that three-digit number quietly shaping your financial destiny. In India, where 2025 brings record loan disbursals of Rs. 55 lakh crore and digital credit booming, your CIBIL score is more powerful than ever. This guide demystifies what CIBIL is, its factors, loan impact, checking methods, improvement tips, myths busted, and more, all as clear as chatting over chai. Let’s explore the best CIBIL score improvement offers to unlock your borrowing potential.

What is CIBIL Score and Its Importance

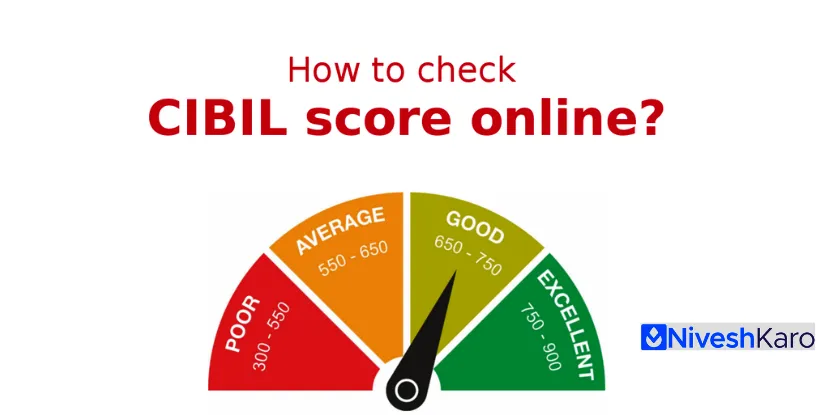

The CIBIL score, ranging from 300 to 900, is a credit health report card issued by TransUnion CIBIL, India's leading credit bureau. It summarizes your borrowing history—payments, debts, and behavior—predicting repayment likelihood. Scores above 750 signal "low risk"; below 650, "high risk." In 2025, with 80 crore credit-active Indians and banks rejecting 30% loans due to low scores, per RBI data, CIBIL is your financial passport.

Importance:

• Loan Approvals: 70% approvals for 750+ scores vs 20% below 650.

• Interest Rates: 8.5% for 800+ vs 12% for 650—saves Rs. 2 lakh on Rs. 20 lakh home loan.

• Credit Limits: Higher cards (Rs. 5 lakh vs Rs. 50,000).

• Financial Freedom: Builds trust for business loans, rentals.

A small-town shopkeeper's 720 score secured Rs. 10 lakh business loan at 9%, fueling expansion. Many dismiss scores as "bank jargon"—wrong, it's your money multiplier. It's like a report card—good grades open doors. Use niveshkaro.com/calculator to preview impact. Consult a certified advisor to decode yours.

Factors Affecting Your Credit Score

Your CIBIL score is 35% payment history, 30% credit utilization, and more—banks weigh these dynamically in 2025:

• Payment History (35%): On-time EMIs boost scores 50 points; 90-day delay drops 100. E.g., missed credit card bill tanks score from 780 to 680.

• Credit Utilization (30%): Keep <30% of limit used (Rs. 15,000 on Rs. 50,000 card). High usage signals risk—drops 50 points.

• Credit Mix (10%): Balance secured (home loan) and unsecured (personal loan)—diversity adds 20 points.

• Length of Credit (15%): 7+ years history lifts 30 points; new accounts lower initially.

• New Inquiries (10%): >3 hard pulls in 6 months drop 20 points—space applications.

Other: Defaults (150-point drop), bounced cheques. A female professional cleared old dues, jumped from 650 to 780 in 6 months. Many max cards—lose 100 points. It's like a fitness tracker—monitor habits for health. Check niveshkaro.com for factor breakdowns. Consult advisor for personalized audit.

How CIBIL Score Impact Loan Approval and Interest Rates

Your score directly dictates loan fate in 2025's competitive market:

Approval Odds:

• 900-801: 95% approval, instant digital.

• 800-751: 85%, 2-3 days.

• 750-701: 60%, extra docs.

• Below 700: 30%, high rates or rejection.

Interest Rates (Rs. 10 lakh, 5 years):

|

Score |

Rate |

EMI |

Total Interest |

Savings vs 650 |

|

850+ |

8.5% |

Rs. 20,333 |

Rs. 2.2 lakh |

Rs. 50,000 |

|

750 |

9.5% |

Rs. 21,000 |

Rs. 2.6 lakh |

Rs. 25,000 |

|

650 |

12% |

Rs. 22,250 |

Rs. 3.35 lakh |

- |

Real Impact: 800 score saves Rs. 50,000 on Rs. 20 lakh home loan vs 650. In 2025, 70% high-score borrowers get 8.5% rates, per Economic Times. A young earner’s 820 score landed 8.5% personal loan, saving Rs. 15,000. Many ignore scores—pay 2% extra yearly. It's like fuel efficiency—higher score, lower cost. Use niveshkaro.com/calculator for simulations. Consult advisor for rate optimization.

Ways to Check Your CIBIL Score

Checking is free annually, instant online in 2025:

1. CIBIL Website: cibil.com—register with PAN, mobile; get report in 5 minutes (free 1/year, Rs. 550 extra).

2. Bank Apps: SBI YONO, HDFC—linked score in dashboard.

3. Aggregators: niveshkaro.com—compares CIBIL, Experian, Equifax (Rs. 99/month).

4. CreditMantri: Free basic score, detailed Rs. 199.

5. Offline: Bank branch with Form-8 (Rs. 100).

In 2025, 90% checks digital, per TransUnion. A retiree monitored via app, fixed error boosting 50 points. Many check once—miss drops. It's like a health checkup—regular monitoring saves. Check niveshkaro.com for free tools. Consult advisor for report analysis.

Tips to Improve Your Credit Score

Boost your score 100+ points in 6-12 months:

• Pay On Time (35% impact): Auto-debit EMIs—avoids 100-point drops. Set reminders.

• Lower Utilization (30%): Pay cards monthly—keep <20%. E.g., Rs. 10,000 limit, use Rs. 2,000.

• Clear Old Dues: Settle defaults—lifts 150 points in 3 months.

• Limit New Credit: 1 inquiry/6 months—preserves history.

• Diversify Mix: Add 1 secured loan—+20 points.

• Dispute Errors: 10% reports wrong—fix via CIBIL portal (30 days).

Timeline: 3 months (+50 points), 6 months (+100). A small-town earner cleared dues, jumped 620 to 780, got 8.5% loan. Many delay payments—lose 100 points. It's like gym results—consistent effort pays. Check niveshkaro.com for improvement plans. Consult advisor for 90-day strategy.

Common Credit Score Myths Debunked

Bust these 2025 myths:

• Myth 1: "Closing old cards helps"—Wrong, shortens history (-20 points). Keep active, low use.

• Myth 2: "Cash payments boost score"—No, only credit usage counts.

• Myth 3: "Multiple inquiries tank score"—1-2 for loans OK (+10 points if approved).

• Myth 4: "Rent/utilities build score"—Only credit accounts matter.

• Myth 5: "Women get higher scores"—Equal, but women pay 0.25% less on loans.

A young professional kept old card, gained 30 points. Many close accounts—drop 50. It's like urban legends—question everything. Check niveshkaro.com for myth busters. Consult advisor for truths.

Recent Updates in CIBIL Score India 2025

2025 simplifies scores. CIBIL 5.0 adds UPI data—90% accuracy. Free annual checks via RBI mandate. Digital reports up 40%, per TransUnion. Score range unchanged (300-900). A miss: 30% ignore UPI impact—lose 20 points. Check niveshkaro.com for best CIBIL score improvement offers.

Common Mistakes to Avoid

Mistakes hurt:

• Late Payments: Drop 100 points—set auto-debit.

• Max Cards: 80% utilization—lose 50 points.

• Too Many Inquiries: 5 in 6 months—-30 points.

• Ignoring Errors: 10% reports wrong—dispute now.

• Closing Old Cards: Short history—-20 points.

A trader maxed card, score fell 780 to 720.

Life Stage Considerations

Scores fit stages:

• Young (20-35): Build history with cards—aim 750+.

• Mid-life (35-50): Maintain for home loans—800+.

• Seniors (50+): Preserve for emergencies—700+.

A 30-year-old builds score; senior maintains. Consult advisor.

Key Terms and Definitions

Clear terms:

• CIBIL Score: 300-900 credit rating.

• DSR: EMI/income ratio.

• Utilization: Credit used/limit %.

• Hard Inquiry: Loan application check.

Know these for credit health.

FAQs

• What is CIBIL score 2025? 300-900 rating impacting loans—use best CIBIL offers.

• Factors affecting CIBIL? Payments 35%, utilization 30%—check niveshkaro.com.

• How CIBIL affects loans? 750+ = 8.5% rate, saves Rs. 50,000—consult advisor.

• How to check CIBIL free? cibil.com annually, apps instantly—5 minutes.

• Improve CIBIL in 3 months? Pay on time, clear dues—+50 points via niveshkaro.com.

Case Studies and Examples

Meet Priya, a 35-year-old teacher. Score 650 blocked Rs. 15 lakh loan; cleared dues, hit 780 in 6 months, got 8.5% rate—saved Rs. 30,000 with best CIBIL offers.

Conclusion

Your CIBIL score in India 2025 is the key to loan approvals and low rates. Know factors, check regularly, improve smartly, and bust myths. Grab best CIBIL score improvement offers for financial freedom. It's like a credit key—unlock your dreams. Act now: explore tools at niveshkaro.com/compare-plans for a stronger score.

NiveshKaro connects you instantly with certified, unbiased financial advisors registered with IRDA, SEBI, and AMFI. For personalized support and guidance, fill out the form today to start making confident financial decisions.

Subscribe To Our Newsletter

Subscribe to our newsletter to receive up to date news, ideas and resources to help to manage your investment and risks.