In the complex world of personal finance, effective tax planning stands as a crucial element for maximizing your hard-earned money. At NiveshKaro.com, we understand the intricacies of the Indian tax system and are dedicated to helping you navigate it efficiently, ensuring you make the most of available deductions and exemptions.

What is Tax Planning? Tax planning is the analysis of a financial situation or plan from a tax perspective, with the aim of ensuring maximum tax efficiency. It involves making strategic decisions to minimize tax liability within the framework of the law.

Why is Tax Planning Important?

- Increased Savings: Proper tax planning can significantly reduce your tax burden, leaving more money in your pocket.

- Compliance: Ensures you meet all tax obligations while taking advantage of legal provisions for tax savings.

- Financial Goal Achievement: Efficient tax planning can free up funds to meet your financial goals faster.

- Investment Direction: Many tax-saving instruments also serve as good investment options.

- Peace of Mind: Knowing your taxes are optimized reduces financial stress.

Why Consider Tax Planning Now?

- Changing Tax Laws: Stay ahead of amendments in tax regulations.

- Early Planning: Starting early in the financial year allows for better distribution of tax-saving investments.

- Avoid Last-Minute Rush: Prevent hasty decisions made under year-end pressure.

- Maximize Deductions: Ensure you don't miss out on any eligible deductions.

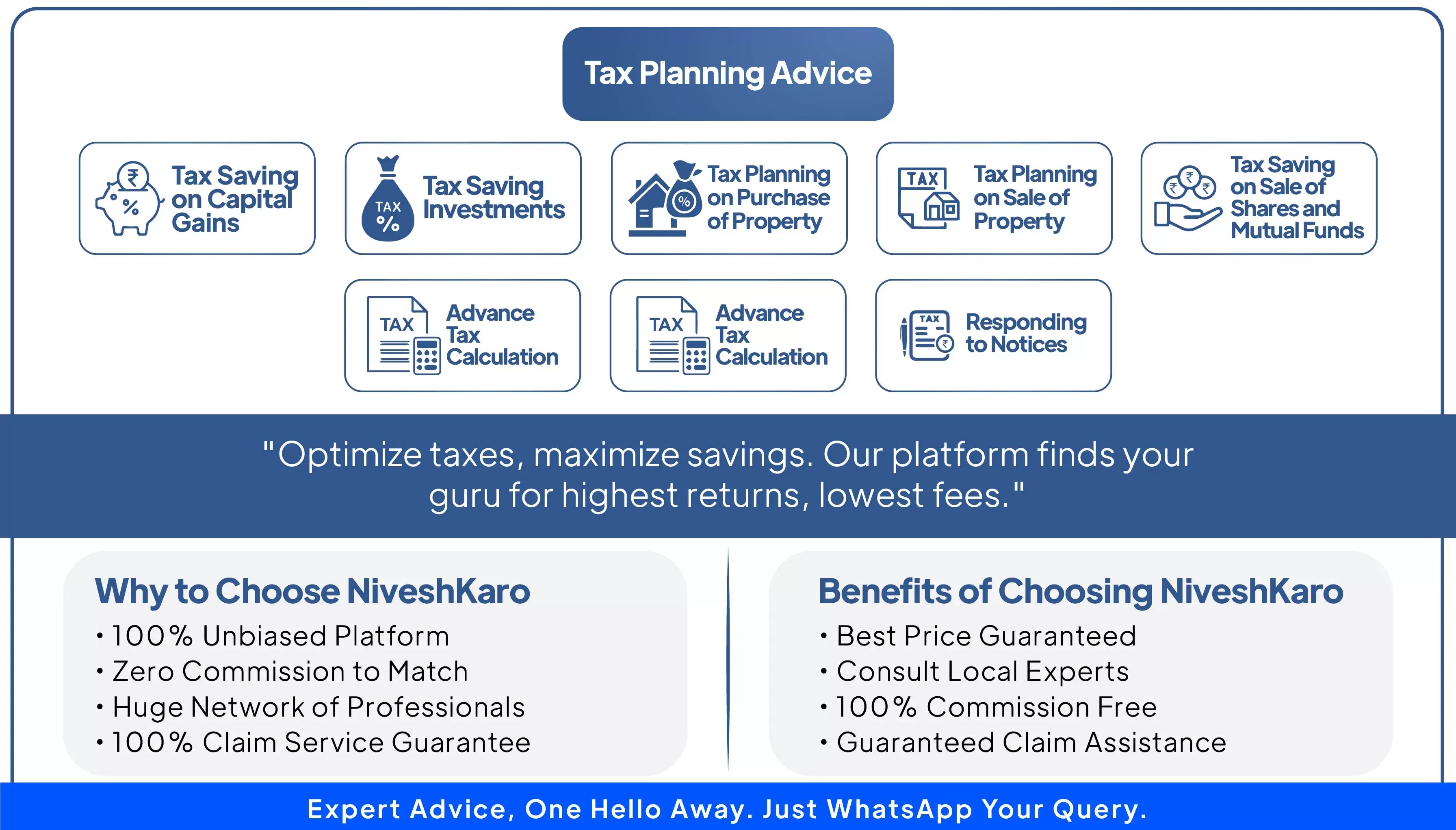

How NiveshKaro.com Can Help Navigating the tax landscape can be daunting. NiveshKaro.com simplifies this process:

- Expert Guidance: We connect you with experienced tax advisors who can explain complex tax laws in simple terms.

- Personalized Strategies: Our network of professionals can create a tax plan tailored to your unique financial situation.

- Unbiased Advice: As a neutral platform, we ensure you receive objective guidance.

- Up-to-date Information: Access to the latest information on tax laws and regulations.

- Holistic Approach: Integrate tax planning with your overall financial planning.

Benefits of Choosing NiveshKaro.com

- Free Service: Our platform is entirely free for users.

- Wide Network: Access a broad range of tax advisors and chartered accountants.

- Educational Resources: Information to help you understand basic tax concepts.

- Ongoing Support: We're here to assist you throughout the tax year.

Taking Action: Optimize Your Taxes Today Effective tax planning is not just about saving money; it's about making informed financial decisions. Don't let the complexity of the tax system deter you from optimizing your finances. Reach out to NiveshKaro.com today to connect with experienced tax advisors who can guide you towards a more tax-efficient financial future.