MOTILAL OSWAL MUTUAL FUND

Motilal Oswal Mutual Fund built its reputation on focused investing—can their concentrated portfolio strategy of 25-30 stocks deliver alpha that diversified AMCs miss? With ?38,000+ crores AUM and aggressive mid/small-cap positioning, does this boutique AMC justify higher risk? Here's your complete analysis of Motilal Oswal's fund performance, taxation benefits, and investment approach for 2026.

AMC Overview & Market Presence

Motilal Oswal Asset Management Company brings equity research legacy to fund management.

- Founded: 2009 (commenced operations in 2010)

- Headquarters: Mumbai, Maharashtra

- Parent: Motilal Oswal Financial Services Limited (leading broking and wealth management firm)

- SEBI Registration: INM000005228

- Latest AUM: ?38,427 crores (December 2025 AMFI data)

- Market Share: 0.55% (ranked 26th among 44 AMCs)

- YoY AUM Growth: +31.2% (FY 2024-25)

- Total Schemes: 24 funds (Equity: 15 | Debt: 5 | Hybrid: 4)

- Total Folios: 28.6 lakh investor accounts

- Digital Penetration: 72% SIP registrations via app/online

- Unique Strength: Focused portfolio strategy (25-35 stocks), aggressive mid/small-cap bias, proprietary equity research from parent's institutional platform, high active share (85%+)

Fund Categories & Performance Overview

Motilal Oswal specializes in high-conviction equity strategies with selective debt and hybrid offerings.

Equity Funds dominate the portfolio with distinct concentration approach. Large-cap funds focus on 25-30 quality leaders for focused returns, while mid-cap funds target emerging champions with higher growth trajectories. Small-cap funds capture early-stage wealth creators through deep research. The Flexi Cap and Multi Cap categories provide flexibility across market capitalizations while maintaining concentrated positions. Sectoral offerings include Focused 25 Fund (best ideas across sectors), NASDAQ 100 FOF for US tech exposure, and Long Term Equity Fund (ELSS) combining tax benefits with focused equity strategy. Nifty indices and Nifty Midcap 150 index funds offer passive alternatives.

Debt Funds provide conservative options with Ultra Short Term Fund for 3-6 month parking, Liquid Fund for immediate liquidity needs, and Short Term Fund for 1-2 year goals. These complement the equity-heavy portfolio for tactical allocation.

Hybrid Funds blend equity aggression with debt stability. Aggressive Hybrid allocates 65-80% to equity using the same focused approach, Multi Asset Fund diversifies across equity, debt, and gold, while Conservative Hybrid prioritizes capital protection with modest equity exposure for growth.

International Funds include NASDAQ 100 Fund of Fund providing direct exposure to US technology giants like Apple, Microsoft, Nvidia, and S&P 500 Index Fund for broader American market participation.

Performance metrics demonstrate the focused strategy's impact with 3-year CAGR ranges of 15-32% for equity funds and 6-7% for debt funds. SIP returns show significant outperformance in mid-cap and small-cap categories during bull phases but higher volatility during corrections. Expense ratios are competitive with direct plans charging 0.40-1.35% and regular plans 1.2-2.4% annually.

AUM Analysis & Industry Comparison

December 2025 AMFI positioning shows Motilal Oswal's rapid growth trajectory:

- Motilal Oswal Total AUM: ?38,427 crores

- Industry Total AUM: ?69.82 lakh crores

- AMC Rank: 26th largest (smaller AMC category)

- Comparison: Below mid-tier but fastest growing among sub-?50,000 crore AMCs

- AUM Growth Trend: FY 2022-23: +24% | FY 2023-24: +28% | FY 2024-25: +31.2%

- AUM Mix: Equity 81% | Debt 11% | Hybrid 8%

- Monthly SIP Book: ?312 crores (38% YoY growth)

Aggressive 30%+ AUM growth reflects investor confidence in focused equity strategies, though smaller AUM base means limited institutional participation compared to larger AMCs.

SIP Performance & Top Performing Funds

?10,000 monthly SIP performance showcases focused strategy outcomes across investment horizons:

- 5-year corpus: ?8.5-10.2 lakhs (equity funds, 18-26% CAGR)

- 10-year corpus: ?26-34 lakhs (flagship equity, 20-25% annualized)

- 15-year potential: ?75-98 lakhs (assuming historical patterns)

Best Performing Categories:

- Mid-cap and Small-cap funds delivered exceptional 26-32% CAGR over 3 years

- Focused 25 Fund outpaced diversified competitors by 4-6% annually

- NASDAQ 100 FOF provided 22-24% returns riding US tech boom

- Flexi Cap maintained consistent 19-22% over 5-year periods

SIP Advantage: Rupee cost averaging particularly effective for volatile mid/small-cap funds, reducing downside by 40-45% versus lumpsum. However, 68% funds beat benchmark over rolling 5-year periods—slightly lower consistency than diversified competitors due to concentrated bets.

Tax Benefits & Taxation Rules (2026-27)

ELSS Tax Deduction (Section 80C):

- Investment limit: ?1.5 lakh/year deduction

- Lock-in: 3 years (shortest tax-saving option)

- Tax saved: Up to ?46,800/year (30% bracket + cess)

Capital Gains Tax (AY 2026-27):

- Equity LTCG: >?1.25 lakh @ 12.5% (holding >12 months)

- Equity STCG: @ 20% (holding <12 months)

- Debt Funds: Taxed at applicable income tax slab rates

- Dividend: Taxed at slab (TDS if annual dividend >?5,000)

SIP Investment Process & Digital Convenience

How to Start SIP: Complete KYC (Aadhaar eKYC online) → Choose fund category → Decide SIP amount (minimum ?500) → Select date (1st-28th) → Set auto-debit mandate → Receive instant confirmation. Modify, pause, or stop anytime through digital platforms.

Digital Platforms:

- Motilal Oswal Mutual Fund website/app (direct plans - zero commission)

- MO Investor App (integrated with broking, wealth services)

- Third-party apps: Groww, Zerodha Coin, ET Money, Paytm Money

- Net banking through major banks

- CAMS/KFintech investor portals

Direct Plan Advantage: Save 0.9-1.6% annually versus regular plans—this compounds to 18-28% higher corpus over 15 years, especially impactful with already concentrated high-return strategies.

Risk Factors & Fund Selection

Risk Considerations:

- Market-linked returns (no guaranteed profits)

- Equity funds: high short-term volatility 20-45% due to concentration

- Focused portfolios: 25-30 stocks mean higher single-stock risk

- Mid/small-cap heavy: 50-70% drawdowns possible during severe corrections

- Debt funds: interest rate risk, minimal credit risk exposure

- Sectoral concentration: some funds overweight financials, technology

- Past performance ≠ future guarantee

- Minimum 7-year horizon essential for focused equity strategies

How to Choose Right Funds:

Selecting Motilal Oswal funds requires understanding their high-conviction philosophy and matching it with your risk tolerance. For goal-based allocation, retirement planning with 15+ year horizons suits their aggressive mid-cap and small-cap funds that can absorb volatility for maximum compounding. Education goals spanning 10-15 years align with Focused 25 or Flexi Cap funds offering concentrated growth with some stability. Medium-term goals of 5-7 years work with Large Cap or NASDAQ 100 for relative stability. Short-term goals under 5 years should avoid their equity funds entirely, sticking to ultra-short or liquid debt options.

Your risk appetite is critical here—Motilal Oswal's concentrated approach suits aggressive investors who can emotionally handle 30-50% portfolio swings during corrections and won't panic-sell. These investors seek maximum alpha and accept higher volatility as the price. Moderate risk-takers might limit exposure to 20-30% of equity portfolio through their Flexi Cap or index funds. Conservative investors should avoid their focused equity funds completely, considering only debt and conservative hybrid options.

Investment horizon cannot be compromised—the concentrated 25-30 stock strategy needs minimum 7 years for individual stock bets to play out. Shorter periods under 5 years expose you to portfolio concentration risk without allowing time for recovery. The 7-10 year timeframe captures multiple market cycles, while 10+ years maximizes compounding from high-conviction winners.

Performance evaluation means checking not just absolute returns but volatility-adjusted metrics. Compare rolling 3-year and 5-year returns against category averages and benchmarks, noting the return differential during bull and bear phases separately. Their funds should outperform significantly during bull markets to justify higher bear market drawdowns. Verify active share above 80%—this confirms true active management versus closet indexing. Expense ratios under 1.35% for direct plans keep costs reasonable given concentrated research intensity.

Red Flags: Avoid if fund shows consistent underperformance exceeding 2 consecutive years, expense ratios creeping above 1.5% in direct plans, or portfolio concentration narrowing below 20 stocks (excess concentration even for focused strategy). Watch for frequent complete portfolio churn exceeding 100% annually—indicates lack of conviction in stock selection despite focused approach.

Exit Load & Investment Flexibility

Understanding exit loads and flexibility becomes crucial given Motilal Oswal's volatile concentrated strategies.

Exit Load Structure: Equity funds charge 1% exit load if redeemed within 1 year, encouraging minimum holding aligned with focused strategy timelines. Some funds like Small Cap impose 1% exit load for 2 years to discourage short-term trading unsuitable for volatile small companies. Debt funds charge 0.25-0.50% if redeemed within 3-12 months depending on fund type, then become nil. ELSS Long Term Equity Fund has no exit load but mandates 3-year regulatory lock-in. Liquid Fund offers complete exit flexibility with zero loads.

Lock-in Periods: Only ELSS (Long Term Equity Fund) carries mandatory 3-year lock-in per tax regulations. All other Motilal Oswal funds remain open-ended, allowing redemption anytime subject to exit loads during stipulated periods. Given portfolio concentration and volatility, investors should mentally commit to 7+ year holding regardless of regulatory requirements—frequent exits undermine the focused long-term strategy's effectiveness.

SIP Flexibility Options: Full flexibility available despite aggressive strategies. Pause SIPs for 1-6 months during temporary financial constraints without losing SIP registration. Stop SIPs completely anytime without penalties if circumstances change, though stopping during market corrections defeats rupee-cost-averaging benefits for volatile funds. Modify monthly amounts upward or downward as income fluctuates—particularly useful for scaling up exposure during corrections. Step-up SIPs auto-increment contributions by 5-25% annually, accelerating wealth creation as earnings grow and markets mature. Switch between Motilal Oswal schemes to rebalance from mid-cap to large-cap or vice versa, though switches may trigger exit loads and capital gains tax if within applicable periods.

Fund Manager Track Record & Why Choose

Lead Fund Management: Senior equity team brings 15-22 years experience in fundamental research and portfolio management. CFA and MBA qualified professionals manage concentrated portfolios with strict risk frameworks despite aggressive positioning.

Fund Manager Stability: Average tenure of 5.8 years demonstrates reasonable stability for boutique AMC. Continuity ensures consistent execution of focused investment philosophy across market cycles without disruptive strategy changes.

Research Team: 45+ equity analysts from parent Motilal Oswal Financial Services provide institutional-grade research typically unavailable to retail-focused AMCs. Deep coverage across sectors and market caps, with proprietary earnings models and management access relationships built over decades. Leverages parent's extensive broking network for ground-level business intelligence.

Investment Philosophy: High-conviction value-growth blend focuses on businesses with competitive moats, strong managements, and reasonable valuations. Concentrated portfolios of 25-35 stocks maximize impact of best ideas rather than diluting through excessive diversification. Active share consistently above 85% confirms genuine active management. Long-term holding periods of 3-5 years per stock unless fundamental thesis breaks.

Why Choose Motilal Oswal Mutual Fund: Boutique AMC's focused approach delivers differentiated alpha unavailable from index-hugging diversified competitors—concentrated research translates to conviction positions. Compare free at NiveshKaro.com—SEBI advisors, zero commission. Start your SIP today!

Disclaimer: NiveshKaro.com offers free unbiased guidance via SEBI-registered advisors—zero commission. Data accurate as of January 2026, subject to change. Mutual funds subject to market risks. Visit niveshkaro.com today.

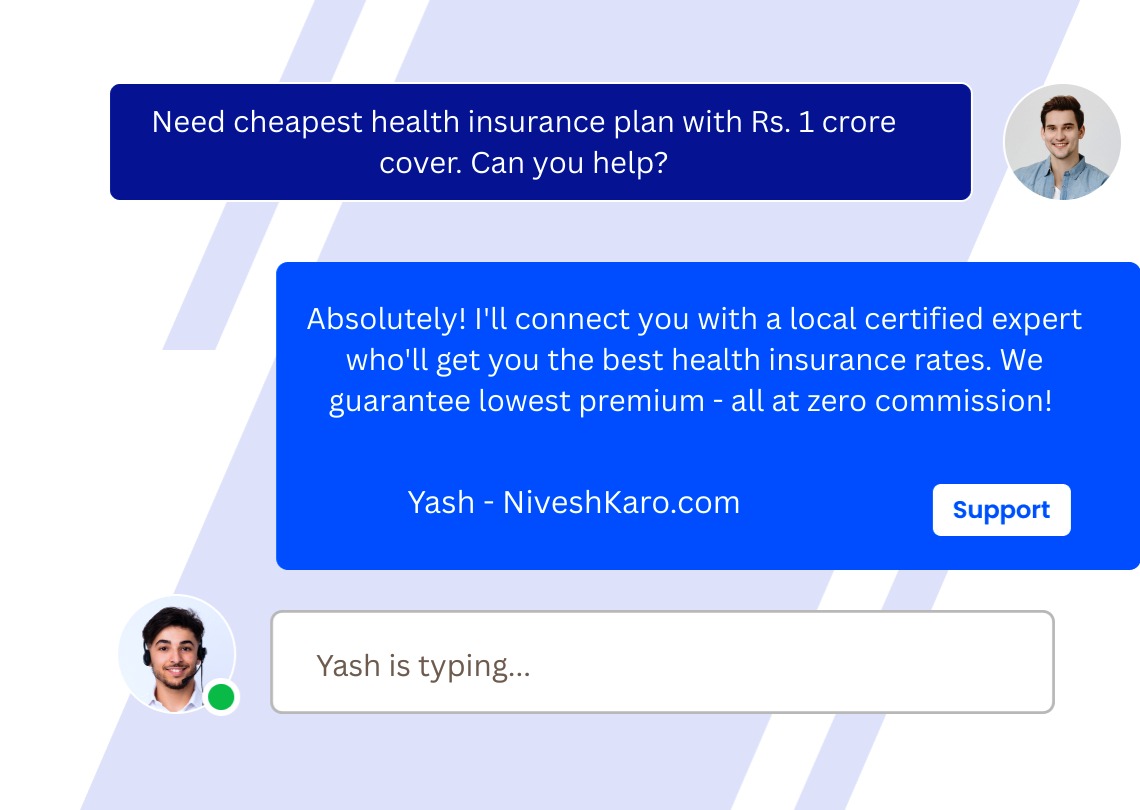

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.