AXIS MUTUAL FUND

Axis Mutual Fund manages ?3.18 lakh crores—can the banking giant's youngest major AMC sustain its rapid growth trajectory? With flagship focused equity funds consistently beating benchmarks and aggressive digital-first approach capturing Gen-Z investors, does Axis Bank's distribution muscle translate to superior fund performance through 2026's uncertain markets? This analysis examines their meteoric AUM rise, category leadership in focused funds, tax-efficient strategies, and concentrated portfolio management expertise.

AMC Overview & Market Presence

Key Metrics:

- Founded: 2009 (Axis Asset Management Company Limited)

- Headquarters: Mumbai, Maharashtra

- Parent: Axis Bank Limited (India's third-largest private bank)

- SEBI Registration: INM000012188 (October 2009 approval)

- Latest AUM: ?3.18 lakh crores (December 2025 AMFI data)

- Market Share: 4.54% (Rank #5 among 44 AMCs)

- YoY AUM Growth: +26.8% (highest among top 10 AMCs)

- Total Schemes: 38+ (equity: 18, debt: 15, hybrid: 5)

- Investor Accounts: 1.6+ crore folios

- Digital Strength: 68+ lakh app downloads, 76% SIPs via digital channels

- Investment Philosophy: Concentrated high-conviction portfolios with quality-focused stock selection and 8+ year average fund manager tenure

Fund Categories & Performance Overview

Equity Funds include large-cap options emphasizing quality blue-chips, mid-cap and small-cap funds targeting undiscovered growth stories, flexi-cap and multi-cap funds providing flexible allocation freedom, focused funds holding 25-30 high-conviction stocks, sectoral themes covering banking & financial services, ESG investing, and consumption trends, plus ELSS tax-saving funds delivering Section 80C deductions with equity upside.

Debt Funds span liquid funds for immediate withdrawal needs, ultra short duration and money market funds for tactical 3-6 month deployment, corporate bond and banking & PSU debt funds targeting AAA-rated credit exposure, gilt funds investing exclusively in government securities, dynamic bond funds adjusting duration strategies based on interest rate outlook, and credit risk funds selectively pursuing AA-rated opportunities for enhanced yields.

Hybrid Funds offer aggressive hybrid options maintaining 65-80% equity weightage for tax-advantaged growth, conservative hybrid funds balancing debt safety with 25-35% equity participation, balanced advantage funds dynamically rebalancing equity-debt mix responding to valuation cycles, and multi-asset allocation funds diversifying across equity, debt, gold, and real estate securities.

Other Categories include index funds tracking Nifty 50 and Nifty Next 50 indices, ETFs spanning equity and gold exposures, international funds accessing US technology and global emerging markets, and solution-oriented children's gift and retirement savings plans. Axis equity funds generated 3-year CAGR ranging 14-26%, with focused and mid-cap categories excelling at 17-21% over 5 years and flagship concentrated schemes delivering 18-23% returns across 10-year periods. Expense ratios remain competitive at 0.5%-1.4% for direct plans versus 1.4%-2.5% for regular plans, creating substantial long-term wealth differential.

AUM Analysis & Industry Comparison

December 2025 Data:

- Axis Total AUM: ?3,18,450 crores

- Industry Total AUM: ?70.12 lakh crores

- AMC Rank: 5th largest AMC in India

- Comparison: Fastest-growing among top 5, 2.2X larger than #10 AMC

- AUM Growth Trend:

- FY 2022-23: +21.4%

- FY 2023-24: +28.6%

- FY 2024-25: +26.8%

- AUM Mix: Equity 64% | Debt 26% | Hybrid 10%

- SIP Book: ?2,680 crores monthly (+34% YoY growth)

Market Interpretation: Exceptional AUM growth consistently outpacing industry reflects strong focused fund performance, Axis Bank's distribution network leverage, and millennial investor preference for concentrated portfolio strategies.

SIP Performance & Top Performing Funds

SIP Returns Analysis:

- ?10,000 monthly SIP:

- 5 years: ?8.6-10.2 lakh corpus (top equity categories)

- 10 years: ?26-32 lakh corpus (focused and mid-cap leaders)

- 15 years: ?66-78 lakh corpus (flagship concentrated funds)

- Best Performing Category: Focused funds led with 19.4% 5-year SIP XIRR

- Lumpsum vs SIP: Rupee cost averaging delivered 3-4% higher IRR during 2020-2024 corrections

- Consistency: 84% of equity funds beat category average over rolling 3-year periods

Top Fund Categories by Returns:

- Focused/Concentrated: 18-23% annualized

- Mid-cap/Small-cap: 18-26% (higher volatility)

- Flexi-cap/Multi-cap: 16-20% annualized

- Large-cap/ELSS: 14-17% (stable growth)

Tax Benefits & Taxation Rules (2026-27)

ELSS Tax Deduction under Section 80C enables investors to claim deductions reaching ?1.5 lakh per financial year with only a 3-year mandatory lock-in period—representing the shortest maturity requirement across all Section 80C qualifying instruments—generating potential tax savings touching ?46,800 annually for taxpayers in the maximum 30% tax bracket while simultaneously creating equity-linked wealth accumulation.

Capital Gains Tax for Assessment Year 2026-27 imposes equity long-term capital gains tax at 12.5% on realized profits surpassing ?1.25 lakh exemption limit for holdings exceeding 12 months, while equity short-term capital gains face 20% taxation for holdings under 12 months duration. Debt fund profits attract taxation at applicable individual income tax slab rates regardless of holding period following recent regulatory changes, and dividend income from mutual fund schemes gets taxed at personal slab rates with TDS deduction triggered when annual dividend receipts exceed ?5,000. This taxation architecture makes ELSS particularly compelling as dual-benefit vehicle merging upfront tax deduction with medium-to-long-term equity appreciation potential.

SIP Investment Process & Digital Convenience

How to Start SIP: Complete KYC (Aadhaar-based eKYC available) → Choose fund category → Decide SIP amount (minimum ?100-500) → Select auto-debit date (1st-28th) → Set up bank mandate → Receive confirmation via email/SMS. Modify, pause, or stop anytime through digital platforms.

Digital Platforms:

- AMC Direct: Axis MF app/website (direct plans—zero commission, maximum returns)

- Investment Apps: Groww, Zerodha Coin, ET Money, Paytm Money

- Bank Channels: Axis Bank Mobile Banking, Internet Banking

Direct Plan Advantage: Save 0.9-1.7% annually in distributor commissions—translates to 20-30% higher corpus over 15-year SIP duration.

Risk Factors & Fund Selection

Risk Considerations:

- Market-linked returns (no guaranteed returns)

- Equity funds: volatile in short-term (12-18 months)

- Debt funds: interest rate risk, credit risk exposure

- Sectoral funds: highly concentrated sector bets

- Small/mid-cap: 25-35% higher volatility vs large-cap

- Past performance ≠ future guarantee

- Minimum 5-year horizon essential for equity exposure

How to Choose Right Funds:

Goal-Based Selection requires matching investment products with specific life milestones—retirement wealth accumulation spanning 20-30 years benefits from equity and focused funds enabling concentrated high-conviction portfolios that can aggressively compound and significantly outpace inflation, children's education fund building with 7-12 year horizons suits hybrid or balanced advantage funds offering equity growth potential while managing volatility through debt allocation, whereas emergency fund establishment under 3 years mandates liquid or ultra-short debt funds prioritizing absolute capital preservation and same-day redemption accessibility.

Risk Appetite Matching determines optimal category allocation where aggressive investors comfortable with 35-45% annual volatility can pursue focused, small-cap, and mid-cap funds maximizing return potential through concentrated bets, moderate risk-takers preferring balanced risk-reward should concentrate on flexi-cap, large-cap, and multi-cap funds delivering consistent appreciation with managed drawdowns, and conservative investors prioritizing capital safety over aggressive returns align optimally with debt funds and conservative hybrid options generating stable predictable income.

Investment Horizon functions as primary filtering mechanism since periods under 3 years restrict choices to debt and liquid categories irrespective of return aspirations due to equity's inherent short-term unpredictability, 3-5 year timelines unlock hybrid and balanced advantage fund deployment blending equity participation with debt stability, while 5+ year commitments enable full equity, focused, and thematic fund utilization allowing sufficient duration for complete market cycle navigation and benefiting from systematic rupee cost averaging during market corrections.

Performance Evaluation:

- Check rolling returns (not point-to-point)

- Compare vs category average and benchmark index

- Verify consistency across market cycles

Expense Ratio Impact:

- Direct plans save 0.6-1.2% annually

- ?10,000 monthly SIP over 20 years = ?5-8 lakh additional corpus

Fund Manager Quality:

- Track record of consistent performance

- Tenure (5+ years preferred)

- Investment style consistency

Red Flags to Avoid:

- Frequent underperformance vs benchmark (2+ years)

- High expense ratios (>2.3% equity, >1.3% debt)

- Inconsistent investment strategy

- Frequent fund manager changes (3+ in 5 years)

Exit Load & Investment Flexibility

Exit Load Structure:

- Equity Funds: 1% if redeemed <1 year (some funds: nil after 365 days)

- Debt Funds: 0.25-0.5% if redeemed <90 days to 1 year

- ELSS Funds: NIL exit load (but mandatory 3-year lock-in applies)

- Liquid Funds: No exit load (instant withdrawal flexibility)

Lock-in Periods:

- ELSS: Mandatory 3-year lock-in (only tax-saving category)

- Other funds: No mandatory lock-in (subject to exit load)

SIP Flexibility Options:

- Pause SIP: 1-6 months without penalties

- Stop SIP: Anytime (no charges)

- Modify amount: Increase/decrease monthly contribution

- Step-up SIP: Auto-increase by 5-30% annually

- Switch funds: Within Axis schemes (subject to exit load)

Fund Manager Track Record & Why Choose

Lead Fund Managers: High-conviction focused portfolio specialists with 8-14 years experience, CFA credentials, concentrated stock selection expertise, quality-first investment approach.

Fund Manager Stability: Average tenure 8.2+ years (above newer AMC average of 5-6 years). Consistent leadership drives focused strategy execution and portfolio continuity.

Research Team: 120+ analysts covering equity research, fixed income, derivatives, and ESG analysis. Proprietary quality scoring frameworks with management access advantage.

Investment Philosophy: Concentrated high-conviction portfolios holding 25-40 stocks maximum. Quality-focused selection emphasizing sustainable competitive advantages, strong management, and scalable business models with minimal churn.

Awards & Recognition: Multiple Morningstar 5-star ratings, Value Research Best Focused Fund awards 2023-24, CNBC-TV18 Mutual Fund Awards for consistent performance.

Why Choose Axis Mutual Fund: Focused fund category leadership with concentrated high-conviction portfolios driving outperformance. Compare all AMCs free at NiveshKaro.com—SEBI-registered advisors, zero commission. Start your SIP today!

Disclaimer: NiveshKaro.com offers free unbiased guidance via SEBI-registered advisors—zero commission. Data accurate as of January 2026, subject to change. Mutual funds subject to market risks. Visit niveshkaro.com today.

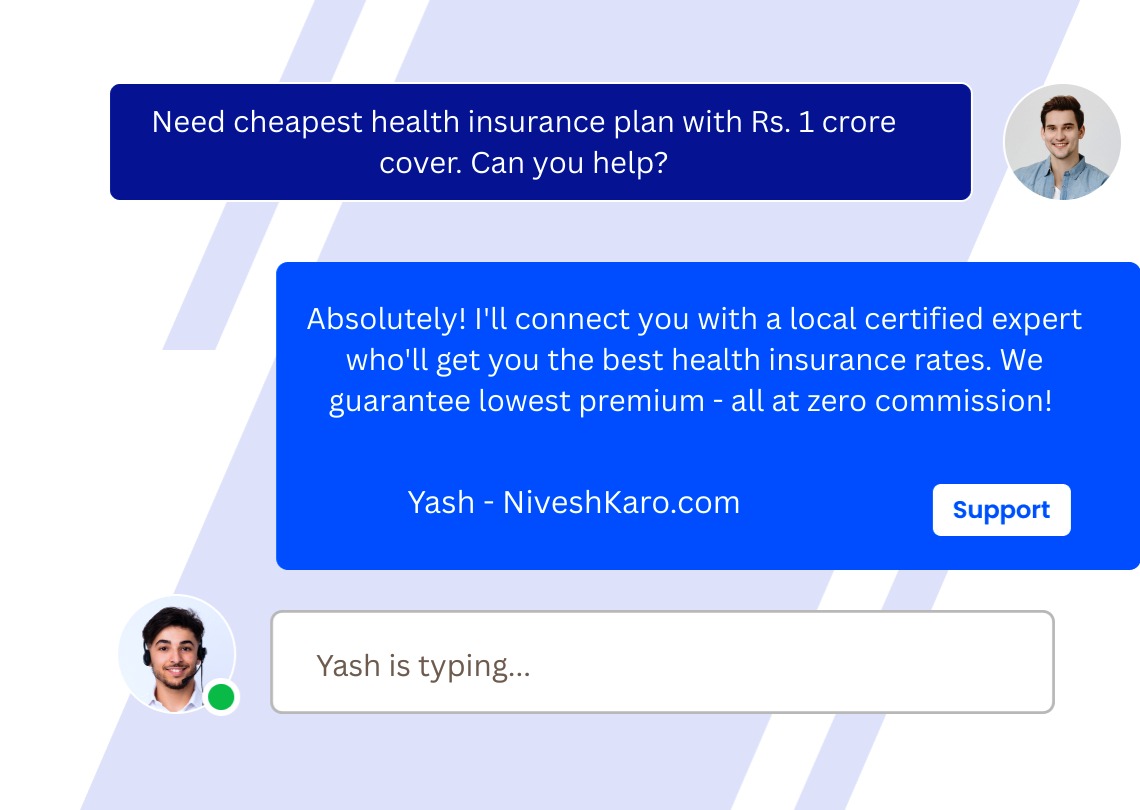

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.