Senior Citizen Saving Scheme

Can SCSS's 8.2% quarterly interest beat all retirement income options for Indians above 60? With sovereign guarantee and regular payouts, does this scheme provide retirees their most reliable post-retirement income stream without market dependency?

Investment Overview & Key Features

Senior Citizen Savings Scheme is a government-backed savings program launched in 2004 exclusively for retirees. Administered by Ministry of Finance through post offices and authorized banks, SCSS provides highest regular income among risk-free instruments.

- Current interest rate: 8.2% per annum (Q4 FY 2025-26)

- Interest payout: Quarterly (every 3 months to bank account)

- Rate revision: Quarterly by Ministry of Finance

- Minimum deposit: ?1,000 (multiples of ?1,000)

- Maximum deposit: ?30 lakh per individual (?60 lakh for couples)

- Account maturity: 5 years (extendable by 3 years once)

- Premature closure: Allowed after 1 year with penalty

- Eligibility age: 60+ years (55+ for VRS/superannuation)

- Taxation status: EET (investment exempt, interest taxable, maturity exempt)

Joint accounts permitted with spouse. Single account per individual or joint account—cannot have both simultaneously. TDS deducted if quarterly interest exceeds ?50,000 annually.

Interest Rates & Returns Analysis

8.2% quarterly payout translates to effective 8.43% annual yield due to compounding if interest is reinvested. On maximum ?30 lakh deposit, quarterly interest reaches ?61,500 (?2.46 lakh annually)—substantial regular income for retired households managing monthly expenses.

Comparing peer instruments: SCSS 8.2% significantly exceeds post office Monthly Income Scheme 7.4%, bank senior citizen FDs 7-7.75%, and RBI Floating Rate Bonds 8.05%. Among government-guaranteed schemes, only Sukanya Samriddhi (8.2%) matches SCSS rate, but SSY targets daughters while SCSS serves retirees.

Real returns after 4.5% inflation adjustment: 3.7% preserves purchasing power moderately. However, taxable interest reduces post-tax returns. For 20% bracket seniors, effective return drops to 6.56% (8.2% minus 20% tax), and for 30% bracket to 5.74%, lowering inflation-adjusted real returns to 2.06-1.24%.

Tax Benefits & Taxation Rules (AY 2026-27)

SCSS deposits qualify for Section 80C deduction up to ?1.5 lakh limit under old tax regime. New tax regime doesn't allow this deduction—most retirees with pension income stay on old regime to utilize 80C, making SCSS investment tax-deductible for majority senior citizens.

Interest taxation: Quarterly interest fully taxable as "Income from Other Sources" at applicable slab rates. Banks/post offices deduct TDS at 10% if total interest exceeds ?50,000 per financial year (enhanced threshold for senior citizens versus ?40,000 for others).

Submit Form 15H if annual income below ?3 lakh to prevent TDS deduction, though interest remains taxable—form only stops advance tax deduction, doesn't eliminate tax liability if total income exceeds basic exemption.

Maturity proceeds: Principal amount returned at maturity is tax-free. Only interest earned during 5-year tenure attracts tax annually, not maturity corpus. SCSS follows EET taxation—initial investment gets 80C deduction, interest taxed yearly, principal return exempt.

Why SCSS Matters to Indian Senior Citizens

Predictable Monthly Income: Quarterly ?61,500 interest on ?30 lakh (?20,500 monthly equivalent) provides reliable cash flow for household expenses—groceries, utilities, medicines—without touching principal, crucial for retirees without salary replacing pension gaps.

Capital Safety Guarantee: Sovereign backing eliminates market risk completely. Unlike equity mutual funds' 20-30% annual volatility unsuitable for seniors needing stability, SCSS principal remains protected regardless of stock market crashes or economic downturns.

Higher Than FD Rates: 8.2% SCSS beats regular bank FDs (6.5-7%) and even senior citizen FD premiums (7-7.75%), maximizing retirement corpus yield. On ?30 lakh, earning extra 0.5-1.7% annually means ?15,000-51,000 additional annual income—significant for fixed-income households.

Immediate Liquidity Access: Quarterly payouts eliminate waiting for annual interest like PPF. Regular cash credits to savings account provide liquidity for immediate expenses—medical emergencies, grandchildren's gifts, home repairs—without disturbing investment principal.

Post-Retirement Corpus Deployment: Retiring employees receive PF accumulation, gratuity, leave encashment totaling ?20-50 lakh. SCSS accepts this retirement corpus immediately (within 1 month of retirement for amounts exceeding ?15 lakh from employer), converting lump sum into steady income stream.

Inflation Hedge Potential: Interest rates revised quarterly based on government securities yields. If inflation rises causing RBI repo rate hikes, SCSS rates increase accordingly (as seen when rates rose from 7.4% to 8.2% in 2023-2024), providing partial inflation protection unlike fixed annuities.

Eligibility & Investment Process

Indian residents aged 60+ years can invest. Early retirees aged 55-60 under Voluntary Retirement Scheme (VRS) or superannuation also eligible—must invest within 1 month of retirement funds receipt. Defense personnel qualifying for superannuation (even below 55) can invest. Requirements:

- Age proof (Aadhaar/PAN/Passport showing 60+ age)

- Retirement documents (for 55-60 age VRS cases)

- Identity proof (Aadhaar card mandatory)

- Address proof (Utility bill/Passport)

- PAN card (compulsory for deposits)

Visit post office or authorized banks (SBI, PNB, ICICI, Axis, HDFC participating). Fill account opening form selecting single or joint account mode. Provide nominee details (spouse/children—mandatory). Deposit via cash/cheque/DD. Passbook issued containing account details and quarterly interest credit dates.

Net banking facility available for account opening at select banks—upload documents, complete e-KYC via Aadhaar OTP, transfer deposit amount electronically, receive account confirmation within 2-3 days.

Liquidity & Withdrawal Rules

SCSS balances lock-in discipline with senior citizens' potential emergency needs through structured withdrawal provisions.

5-year lock-in: Maturity after 5 years from deposit date. On maturity, choose full withdrawal receiving principal plus final quarter's interest, or extend tenure by additional 3 years retaining principal while continuing quarterly interest at then-prevailing rates.

Premature closure: Allowed after account completion of 1 year. Withdrawing during years 1-2 incurs 1.5% penalty on deposit (?45,000 on ?30 lakh). Closure after 2 years but before 5 years attracts 1% penalty (?30,000 on ?30 lakh). Penalty deducted from principal before refund.

Interest cessation: Quarterly interest stops from next quarter following premature closure. No pro-rata interest for partial quarter—only completed full quarters earn interest. Premature withdrawal during medical emergencies or urgent financial needs justified, though penalty unavoidable.

No partial withdrawal: Cannot withdraw ?5-10 lakh while keeping remaining invested—complete account closure mandatory even for accessing small amounts, forcing seniors to choose between liquidity needs and losing interest stream.

Extension option: One-time 3-year extension allowed on maturity. Inform post office/bank 1 month before 5-year completion. Extension continues at maturity date's prevailing SCSS rate (may differ from original 8.2% if rates change), without fresh deposit requirements.

Risk Factors & Suitability

Interest rate volatility: Current 8.2% not permanent—Ministry of Finance revises quarterly. Potential decline to 7.5-7.8% if government bond yields fall reduces income for new investments and extensions, impacting retirees dependent on fixed quarterly amounts for budgeting.

Taxable income burden: Unlike PPF's tax-free interest, SCSS interest is fully taxable. Seniors in 20-30% tax brackets lose 20-30% of interest to taxes, reducing effective returns to 5.74-6.56%. Pension + SCSS interest combined may push seniors into higher tax brackets unexpectedly.

Inflation erosion: 8.2% gross return becomes 5.74-6.56% post-tax for taxable seniors. Against 4.5% inflation, real wealth preservation marginal at 1.24-2.06% only. Over 5-8 years, purchasing power of quarterly income declines as living costs rise faster than income growth.

Liquidity constraints: No partial withdrawals or loan facilities against SCSS deposits unlike PPF (allows loans). Medical emergencies exceeding quarterly income require premature closure losing 1-1.5% principal plus future interest stream—financially painful during health crises.

Limited investment ceiling: ?30 lakh maximum restricts affluent retirees with ?50-80 lakh corpus from deploying entire retirement funds at highest government-guaranteed rate. Forces diversification into lower-yielding bank FDs or riskier debt mutual funds for excess amounts.

Suitable for: Risk-averse seniors prioritizing capital safety over growth, retirees needing regular quarterly income for living expenses, those with ?10-30 lakh retirement corpus seeking sovereign-backed yields, conservative investors uncomfortable with equity/debt fund NAV fluctuations.

Avoid if: You need complete liquidity (prefer bank FDs allowing premature withdrawal without penalties), seek tax-free income (PPF/tax-free bonds better), require investment amounts exceeding ?30 lakh individually, or can handle moderate risk for 9-10% returns through conservative debt funds.

Comparison with Alternative Investments

Post Office Monthly Income Scheme (POMIS) offers 7.4% monthly payouts versus SCSS's 8.2% quarterly—SCSS provides 0.8% extra return though payout frequency differs. POMIS suits those preferring monthly over quarterly income.

Bank senior citizen FDs range 7-7.75% with flexible tenures (1-10 years) versus SCSS's fixed 5-year maturity. FDs allow easier premature withdrawal (0.5-1% penalty) without 1-year minimum lock-in, providing better liquidity than SCSS's stricter 1.5% penalty structure.

PPF offers tax-free 7.1% but 15-year lock-in unsuitable for 65-75 year seniors planning 5-8 year horizons. SCSS's 8.2% taxable still beats PPF post-tax for lower bracket seniors, plus 5-year maturity aligns better with elderly liquidity preferences.

RBI Floating Rate Bonds (8.05%) offer semi-annual interest matching SCSS's 8.2% closely, but bonds lack quarterly payout frequency SCSS provides for regular expense management. However, RBI bonds tradable on exchanges provide liquidity advantage over SCSS's premature penalties.

Recent Updates & Regulatory Changes (2025-26)

Interest rate maintained at 8.2% for Q4 FY 2025-26, unchanged since Q2 FY 2023-24 despite speculation of cuts, benefiting existing and new depositors. Investment limit remained capped at ?30 lakh—industry demands for increase to ?50 lakh pending Finance Ministry approval.

Aadhaar-PAN linking made compulsory from April 2025 for all SCSS accounts. Non-compliance freezes quarterly interest credits until linking completed, forcing seniors to complete Aadhaar-PAN seeding avoiding income disruptions.

E-passbooks introduced across all post offices enabling online balance checking, interest credit tracking through India Post mobile app and DigiLocker, reducing branch dependency for passbook updates—significant convenience for mobility-impaired seniors.

Why Choose SCSS & How NiveshKaro Helps

Choose Senior Citizen Savings Scheme for India's highest 8.2% government-guaranteed quarterly income, providing retirees reliable post-retirement cash flows with sovereign safety and predictable quarterly payouts unmatched by market-linked alternatives.

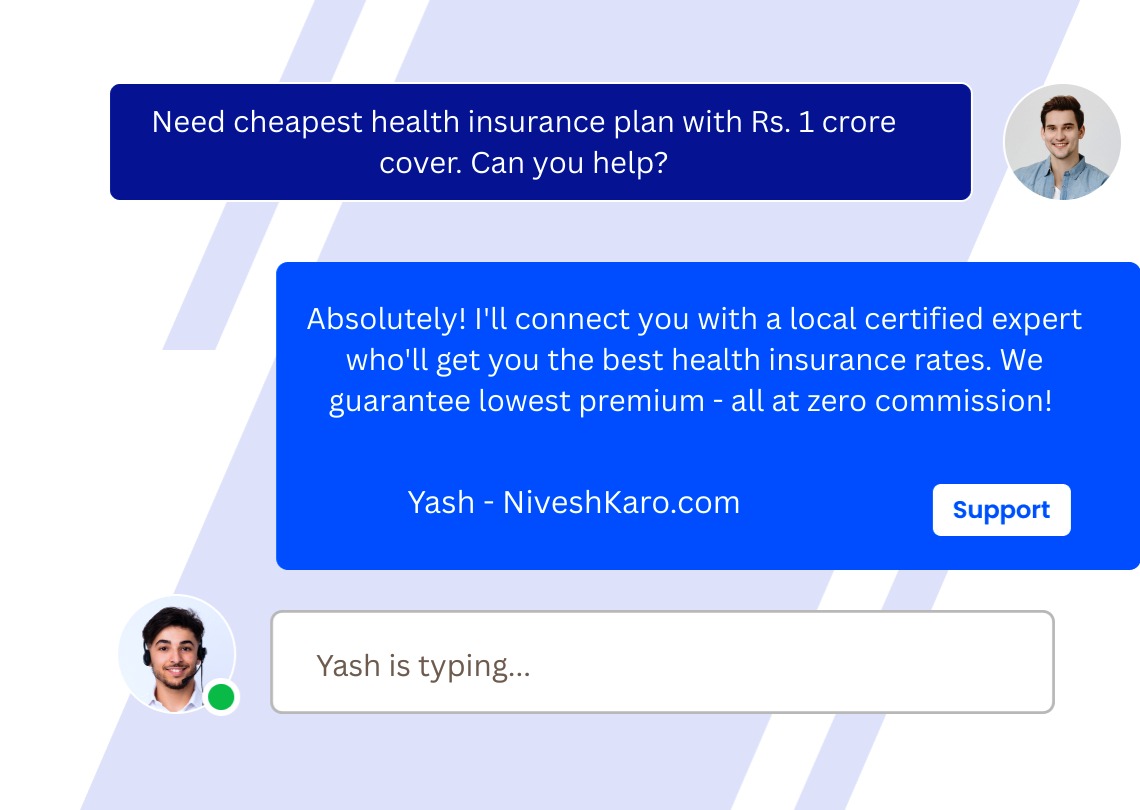

NiveshKaro's SEBI-registered advisors provide free portfolio analysis integrating SCSS with your complete financial plan. Visit NiveshKaro.com for personalized guidance today!

Disclaimer: NiveshKaro.com offers free unbiased guidance via SEBI-registered advisors—zero commission. Data accurate as of January 2026, subject to change. Investments subject to risks—read scheme documents carefully. Visit niveshkaro.com today.

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.