United India Health

Medical costs aren't slowing down—they're climbing 14-16% annually. Can your family afford a ?5 lakh cardiac surgery tomorrow? United India Insurance, a public sector veteran, adapts to 2026's healthcare reality with AI-driven claims, telemedicine integration, and mental health coverage. Here's everything you need to know before buying.

Company Overview

Established in 1938, United India Insurance Company Limited operates from Chennai as a public sector general insurer. IRDAI registration number 145, granted April 5, 2000. FY 2024-25 market share stands at 3.2% with approximately 8.5 million policyholders. Gross Written Premium reached ?12,847 crores, showing 6.8% YoY growth. The network includes 9,200+ hospitals across India. Geographic presence spans 1,450+ branches in 780 cities. Digital sales constitute 28% of total policies.

Product Categories

Coverage options include:

- Individual Health Plans: ?3 lakh - ?25 lakh coverage

- Family Floater Plans: Shared sum insured up to ?50 lakh

- Senior Citizen Plans: Age 60-80 entry, chronic disease management

- Critical Illness Plans: Lump-sum on diagnosis, ?5 lakh - ?1 crore

- Super Top-Up Plans: Deductible-based coverage up to ?1 crore

- Maternity Coverage: Available after 9-month waiting

- Disease-Specific Plans: Diabetes, cardiac care programs

- Corporate Group Plans: Employer-sponsored comprehensive coverage

Features include hospitalization coverage for 24-hour and daycare admissions, pre-hospitalization 30 days and post-hospitalization 60 days, 150+ daycare procedures, flexible room rent options, restoration benefits, NCB up to 50%, AYUSH treatment, ambulance coverage ?2,000, plus 2026 enhancements like mental health counseling, telemedicine consultations, OPD riders, and wellness program rewards.

Claim Settlement Ratio

United India Insurance posted 87.45% CSR for FY 2024-25, slightly below the industry average of 89-90%. The three-year trend shows FY 2022-23 at 86.12%, FY 2023-24 at 86.89%, and FY 2024-25 at 87.45%—demonstrating gradual improvement. Incurred Claim Ratio stands at 94.3%. Interpretation: out of 100 claims submitted, approximately 87 get settled, indicating room for enhancement compared to top private insurers.

Network Hospitals

Network strength includes:

- Total network: 9,200+ hospitals nationwide

- Delhi-NCR: 420+ hospitals

- Mumbai: 385+ hospitals

- Bangalore: 340+ hospitals

- Chennai: 395+ hospitals

- Hyderabad: 310+ hospitals

- Pune: 275+ hospitals

- Kolkata: 360+ hospitals

- Ahmedabad: 245+ hospitals

Top chains include Apollo, Fortis, Max, Manipal, Medanta, Narayana Health. Tier 2/3 cities like Jaipur, Lucknow, Indore maintain solid coverage. Cashless approval averages 3-4 hours for planned procedures, 8-10 hours for emergencies. Reimbursement processing takes 12-18 days. Complaint ratio: 4.2 per 10,000 policies.

Tax Benefits (Section 80D)

Deduction limits under Section 80D:

- Self/spouse/children (below 60): ?25,000

- Self/spouse/children (60+): ?50,000

- Parents (below 60): ?25,000 additional

- Parents (60+): ?50,000 additional

- Preventive check-ups: ?5,000 (within limits)

- Maximum deduction: ?1,00,000/year

Example: A family paying ?40,000 premium for senior parents saves ?15,600 annually in the 30% tax bracket, reducing effective premium cost substantially.

Portability & Claim Rejection Prevention

Portability: Switch insurers while preserving waiting period credits. Apply 45-60 days before policy expiry, submit current policy documents, new insurer requests transfer from previous company, underwriting assessment if coverage increases, seamless transition without gaps. Benefit: completed waiting periods transfer, no restarting disease coverage timelines.

Claim Rejection Prevention:

- Non-disclosure: Declare all pre-existing conditions honestly

- Waiting periods: Verify completion before treatment

- Exclusions: Read policy exclusions carefully

- Documentation: Collect complete bills and reports

- Intimation: Inform insurer within 24 hours

- Network: Use network hospitals for cashless

Exclusions, Support & Recommendation

Waiting Periods:

- Initial: 30 days (accidents day-one)

- Pre-existing diseases: 3-4 years

- Specific diseases: 2 years (hernias, cataracts)

- Maternity: 9 months-3 years

Permanent Exclusions: Cosmetic treatments except accident reconstruction, dental unless accident-related, eyeglasses and hearing aids, self-inflicted injuries, substance abuse, experimental treatments, congenital diseases without riders, infertility treatments.

Customer Support: 24/7 helpline available, mobile app features e-card, hospital locator, claim tracking, email and WhatsApp support, 1,450+ physical branches. Grievance redressal through IRDAI IGMS portal and Insurance Ombudsman.

Why Choose: Public sector reliability, extensive branch network, affordable premiums, improving CSR trajectory. Limitations: CSR below industry average, slower claim processing than top private insurers. Compare free at NiveshKaro.com—IRDAI advisors, zero commission, instant quotes!

Disclaimer: NiveshKaro.com offers free guidance via IRDAI advisors—zero commission. Data accurate as of January 2026, subject to change. Verify terms with United India Insurance. Visit niveshkaro.com today.

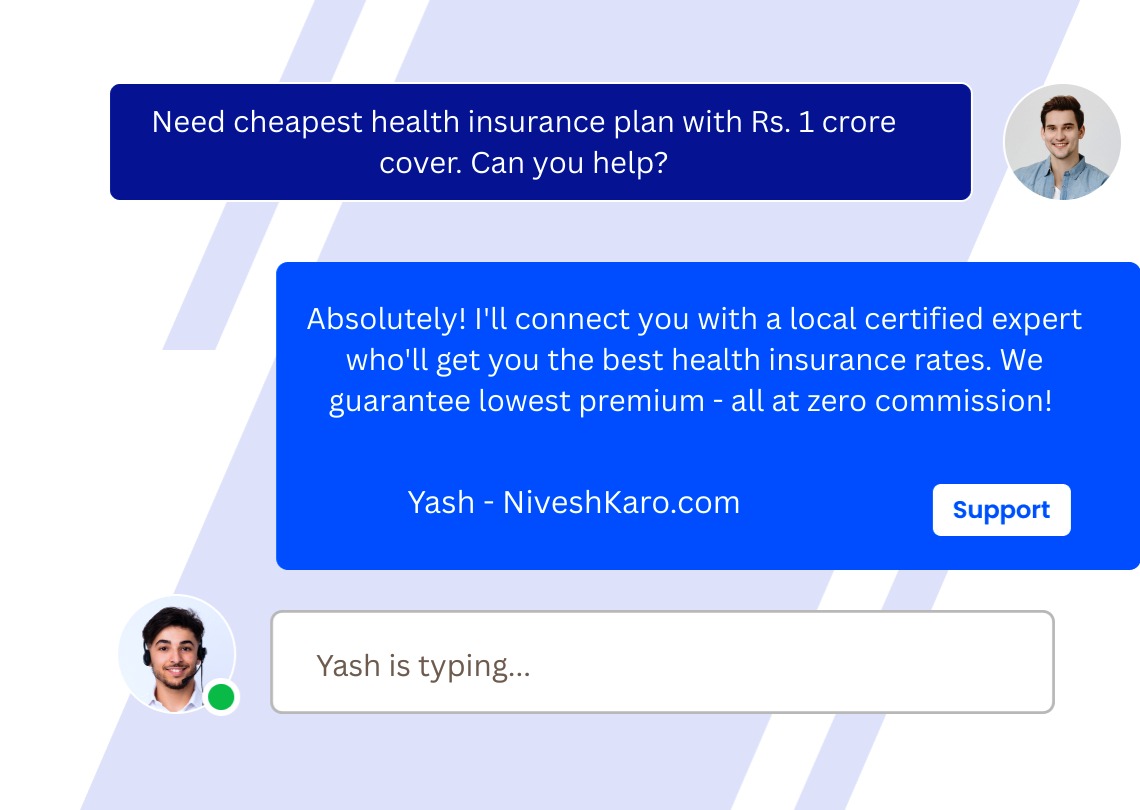

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.