SBI Health Insurance

Banking giant backing health insurance? SBI General leverages India's largest bank network for accessible coverage nationwide. With 14-16% medical inflation squeezing budgets and 10,000+ hospitals accepting cashless claims, can banking expertise translate to healthcare protection? Here's what policyholders gain from this State Bank of India subsidiary.

Company Overview

Established in 2009, SBI General Insurance Company Limited (headquarters: Mumbai) operates as a subsidiary of State Bank of India, India's largest public sector bank. IRDAI registration: 144 (dated June 15, 2009), commenced operations January 2011. With 3.5% general insurance market share in FY 2024-25, ranking 7th among general insurers, serving 3.2 million health policyholders. Gross Written Premium reached ?9,820 crores with 19% YoY growth. Network encompasses 10,200+ hospitals across 650+ cities through 146+ branches nationwide. Digital channels contribute 38% total business, SBI bank network provides extensive distribution.

Product Categories

• Individual Health Plans: ?2 lakh - unlimited coverage

• Family Floater Plans: Shared sum insured up to ?1 crore

• Senior Citizen Plans: Age 60-75 entry, chronic disease coverage

• Critical Illness Plans: Lump-sum on diagnosis, ?10 lakh - ?50 lakh

• Super Top-Up Plans: Deductible-based coverage up to ?50 lakh

• Maternity Coverage: Available in Arogya Premier after waiting

• Disease-Specific Plans: Cardiac, diabetes, cancer management programs

• Corporate Group Plans: Employer-sponsored comprehensive policies

General features include hospitalization (24-hour/daycare), pre-post coverage (30-60 days), 400+ daycare procedures, flexible room rent options, 100% restoration benefits, NCB up to 50%, AYUSH treatments, ambulance (?2,000). 2026 additions: unlimited sum insured options, domiciliary hospitalization, mental health coverage, telemedicine consultations, wellness programs, OPD riders.

Claim Settlement Ratio

SBI General achieved exceptional 98.00% CSR for FY 2024-25, significantly exceeding industry average of 89-90%. Three-year trend demonstrates remarkable consistency: FY 2022-23 at 96.47%, FY 2023-24 at 94.00%, FY 2024-25 at 98.00%—industry-leading performance. Incurred Claim Ratio stands at 72%. Practically, out of 100 claims submitted, 98 get settled. This outstanding CSR reflects SBI's commitment to customer service, backed by parent company's reputation for financial stability and trustworthiness.

Network Hospitals

• Total network: 10,200+ hospitals nationwide

• Delhi-NCR: 285+ hospitals

• Mumbai: 340+ hospitals

• Bangalore: 265+ hospitals

• Chennai: 250+ hospitals

• Hyderabad: 230+ hospitals

• Pune: 215+ hospitals

• Kolkata: 220+ hospitals

• Ahmedabad: 180+ hospitals

Top chains include Apollo, Fortis, Max, Manipal, Medanta, Narayana Health, Columbia Asia, Cloudnine. Tier 2/3 cities like Jaipur, Lucknow, Indore, Coimbatore, Visakhapatnam, Bhopal well-covered. Cashless approval: planned admissions 3-5 hours, emergency 6-8 hours. Reimbursement processes within 10-30 days post-document submission. Complaint ratio: 4.8 per 10,000 policies (FY 2024-25).

Tax Benefits (Section 80D)

• Self/spouse/children (below 60): ?25,000

• Self/spouse/children (60+): ?50,000

• Parents (below 60): ?25,000 additional

• Parents (60+): ?50,000 additional

• Preventive check-ups: ?5,000 (within limits)

• Maximum deduction: ?1,00,000/year

A 38-year-old professional covering senior parents paying ?72,000 annual premium claims ?75,000 deduction (?25,000 self + ?50,000 parents), saving ?23,250 at 31% bracket—significantly reducing effective insurance cost.

Portability & Claim Rejection Prevention

Portability: Transfer to SBI General while retaining waiting period credits from previous insurer. Submit portability application 45-60 days before current policy expiry, provide existing policy documents, SBI verifies transfer request, underwriting conducted if coverage increases, seamless transition ensures continuous protection. Completed waiting periods (pre-existing conditions, specific illnesses) automatically transfer.

Claim Rejection Prevention:

• Non-disclosure: Truthfully declare all pre-existing conditions during purchase

• Waiting periods: Verify completion before scheduling elective procedures

• Exclusions: Carefully review policy document exclusion clauses

• Documentation: Maintain complete hospital bills, discharge summaries, reports

• Intimation: Notify insurer within 24 hours emergency hospitalization

• Network: Use network hospitals ensuring guaranteed cashless facility

Exclusions, Support & Recommendation

Waiting Periods:

• Initial: 30 days (accidents covered day-one)

• Pre-existing diseases: 3-4 years standard

• Specific diseases: 2 years (hernias, cataracts, joint replacements)

• Maternity: 9 months

Note: Portability credits transfer completed waiting periods seamlessly.

Permanent Exclusions: Cosmetic procedures except accident reconstruction, dental treatments unless accident-related, eyeglasses and hearing aids, self-inflicted injuries, substance abuse complications, experimental treatments, congenital diseases in standard plans, infertility treatments without specific riders.

Customer Support: 24/7 helpline (1800-102-1111), mobile app for e-card access, hospital locator, claim tracking, email (customer.care@sbigeneral.in), WhatsApp support, 146+ physical branches, extensive SBI bank branch access. Grievance escalation: IRDAI IGMS portal, Insurance Ombudsman resolution.

Why Choose : SBI General excels with exceptional 98% CSR (industry-leading), State Bank of India's financial backing and nationwide presence, competitive premiums, unlimited coverage options, 100% restoration benefits, 10,200+ hospital network, extensive distribution through banking channels. Limitation: digital penetration lower versus pure-play insurers. Compare policies free at NiveshKaro.com—IRDAI-certified advisors, zero commission, instant quotes!

Disclaimer: NiveshKaro.com offers free guidance via IRDAI advisors—zero commission. Data accurate as of January 2026, subject to change. Verify terms with SBI General Insurance Company Limited. Visit niveshkaro.com today.

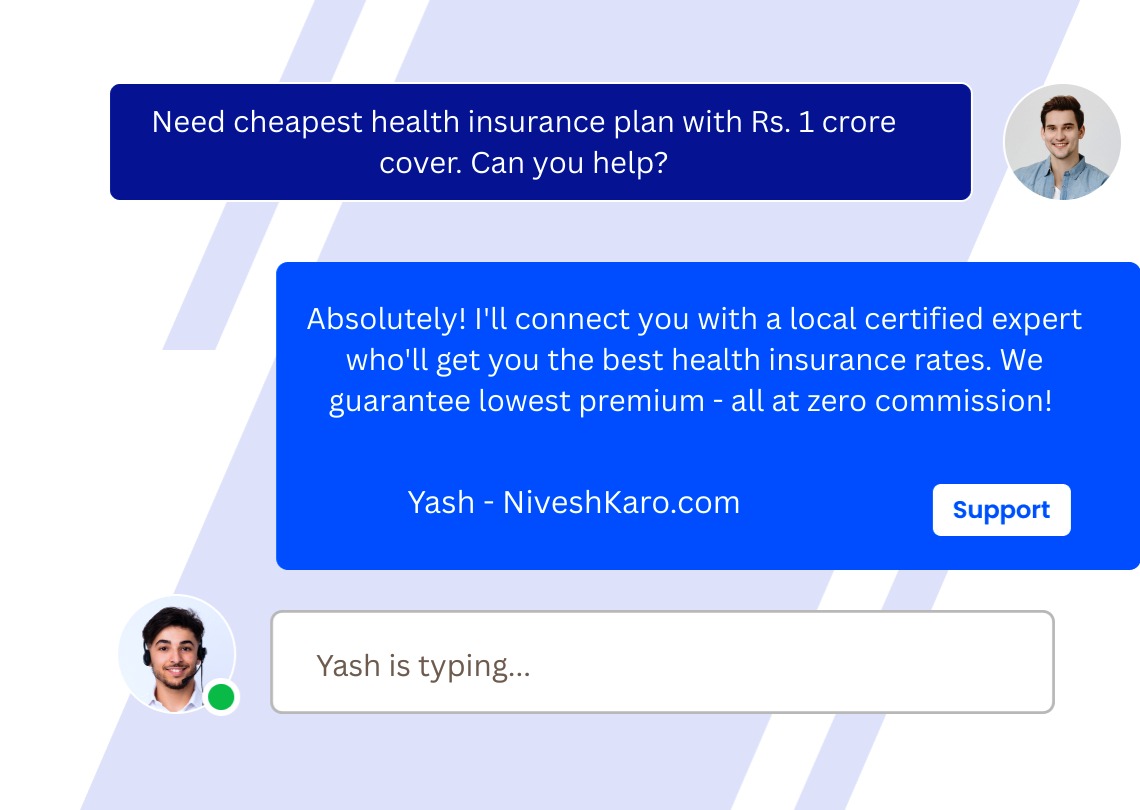

Expert Calling

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.