Individual ITR Filing

Missing July 31 ITR deadline costs ?5,000 penalty plus 1% monthly interest on unpaid tax—can simplified e-filing save your hard-earned money and prevent income tax notices? Does professional assistance ensure maximum refunds while claiming every eligible deduction under Sections 80C to 80U?

What Is ITR Filing & Why It Matters

Income Tax Return (ITR) filing is mandatory annual compliance under Income Tax Act 1961, administered by Income Tax Department. Every individual earning above ?2.5 lakh (?3 lakh for senior citizens 60-80 years, ?5 lakh for super seniors 80+) must file ITR regardless of final tax liability......

Beyond legal obligation, ITR serves critical purposes: loan applications require 2-3 years' ITR as income proof, visa processing demands ITR copies, insurance claims above ?1 lakh need ITR verification, government tenders mandate tax compliance certificates, and carry forward of losses (capital, business, house property) requires timely filing within due dates.

Filing applies to salaried employees, business owners, professionals, freelancers, investors earning capital gains, rental income earners, or anyone with taxable income combinations.

Eligibility & Who Should Apply

Every Indian resident and NRI with gross total income exceeding basic exemption limits must file. This includes:

- Salaried individuals earning ?2.5 lakh+ annually (?3 lakh for senior citizens)

- Business owners and professionals regardless of profit/loss

- Freelancers, consultants, gig workers with income above threshold

- Individuals with capital gains from equity, property, mutual funds

- Those claiming refunds from TDS deductions exceeding actual liability

Even income below taxable limits requires filing if: depositing ?1 crore+ in savings accounts, spending ?2 lakh+ on foreign travel, paying ?1 lakh+ electricity bills annually, or holding directorships in companies. These trigger reporting obligations under seventh proviso to Section 139(1).

Key Benefits & Advantages

Filing ITR delivers tangible advantages beyond avoiding ?1,000-5,000 late fees and prosecution under Section 276CC (imprisonment up to 7 years for tax evasion).

Financial benefits include:

- Tax refunds processed in 20-45 days post-verification when TDS exceeds actual liability

- Carry forward business losses for 8 years, capital losses for 8 years, house property losses for 8 years—impossible without timely filing

- Loan eligibility for home, vehicle, education requiring 2-3 years' ITR as income documentation

- Credit card limit enhancement based on declared income in returns

- Visa processing for US, UK, Schengen requiring 3 years' ITR mandatory

ITR serves as official income proof accepted universally—government tenders, subsidy applications, insurance claims, legal proceedings all recognize filed returns as authentic income documentation where salary slips face credibility challenges.

Documents Required

Gathering documents beforehand speeds filing from 7-10 days to 2-3 days. Essential requirements:

- PAN card and Aadhaar (linked mandatory from 2023-24 onwards)

- Form 16 from employer (Part A for TDS, Part B for salary breakup)

- Form 16A for TDS on interest, rent, professional fees

- Bank statements (savings, current accounts) showing interest earned

- Capital gains statements from mutual funds, equity trades, property sales

- Home loan certificate (interest paid, principal components for 80C, 24B claims)

- Investment proofs: LIC premiums, PPF deposits, ELSS statements, NSC certificates, tuition fee receipts

- Rent receipts or Form 12BB from employer for HRA exemption

- Medical insurance premium receipts for Section 80D (self ?25,000, parents ?25,000 additional if senior citizens ?50,000)

Document requirements vary by income complexity—salaried employees with single employer need fewer documents versus business owners requiring balance sheets, profit-loss statements, GST returns, and audit reports if turnover exceeds ?1 crore.

Step-by-Step Application Process

First, register on Income Tax e-filing portal (incometax.gov.in) using PAN and Aadhaar. Link Aadhaar if not already connected—filing impossible without linkage since AY 2020-21. Then, download Annual Information Statement (AIS) replacing old Form 26AS, showing all TDS credits, interest income, dividend income, mutual fund transactions, property purchases—verify accuracy before proceeding.

Next, select applicable ITR form based on income sources. ITR-1 (Sahaj) covers salary, one house property, other sources income up to ?50 lakh—simplest form for 70% taxpayers. ITR-2 suits salary plus capital gains without business income. ITR-3 applies to business/professional income alongside salary. ITR-4 (Sugam) enables presumptive taxation for businesses under ?2 crore turnover and professionals below ?50 lakh.

Subsequently, enter income details section-wise: salary from Form 16, house property (rental or self-occupied), capital gains (equity sold, mutual fund redemptions, property sales), and other sources (interest, dividends). Calculate deductions under Chapter VI-A—Section 80C (?1.5 lakh for PPF, ELSS, life insurance, tuition fees), 80D (health insurance ?25,000-50,000), 80CCD(1B) (NPS additional ?50,000), 80G (donations), 80E (education loan interest).

Compute tax liability under both old regime (with deductions) and new regime (without deductions but lower slab rates). Choose regime giving lower tax. Pay balance tax via online challan (Challan 280) if liability exceeds TDS already deducted. Finally, verify ITR within 30 days using Aadhaar OTP (instant), net banking, or DSC—unverified returns remain incomplete, blocking refund processing.

Fees & Costs Breakdown

ITR filing through government portal carries NIL charges—completely free for self-filing. However, complexity determines whether professional assistance justifies costs:

- DIY filing: ?0 government fee, time investment 2-5 hours depending on familiarity

- Professional CA charges: ?500-1,000 for salary income (ITR-1), ?1,500-3,000 for capital gains (ITR-2), ?3,000-8,000 for business income (ITR-3/4), ?10,000-25,000 for audit cases

- Belated/revised filing: Same professional charges, but ?5,000 penalty (income >?5 lakh) or ?1,000 penalty (income ?2.5-5 lakh) if filed after July 31 before December 31

- Software/tools: ?200-500 for premium tax calculators, Excel utilities, though free tools available

Total cost for typical salaried individual: ?500-1,500 professional assistance optional, versus potential ?5,000 penalty plus 1% monthly interest on tax dues if delayed beyond deadlines.

Compliance & Renewal Requirements

ITR filing is annual obligation, not one-time registration. Key compliance calendar:

- Original filing deadline: July 31 for individuals, October 31 for audit cases (business turnover >?1 crore or professional receipts >?50 lakh requiring tax audit under Section 44AB)

- Belated filing window: Up to December 31 with ?5,000 penalty (?1,000 if income below ?5 lakh), loses carry forward loss benefits

- Revised filing: Correct errors in original return by December 31 or before assessment completion, whichever earlier

Non-compliance penalties escalate: ?5,000 late fee for missing July 31 (?1,000 for small taxpayers), 1% monthly interest under Section 234A on unpaid tax from August 1 onwards, prosecution under Section 276CC for willful tax evasion (3 months to 7 years imprisonment plus fines). Continued non-filing triggers scrutiny assessments, best judgment additions to income, and freezing of bank accounts under new compliance enforcement.

Annual ITR filing also mandatory for claiming deductions in subsequent years—Section 80C, 80D claims require previous year filing as prerequisite for current year benefit eligibility.

Common Mistakes & How to Avoid Them

Four mistakes account for 65% ITR rejections, delays, and penalty notices.

- Wrong ITR form selection: Using ITR-1 when having capital gains requires ITR-2—results in defective return notice, 15-day correction window else deemed invalid. Verify income combinations against form eligibility before starting.

- Mismatched TDS in AIS vs claims: Claiming ?50,000 TDS when AIS shows ?45,000 triggers automated mismatch notice. Always download AIS first, reconcile with Form 16/16A, report discrepancies to deductor before filing.

- Missing verification within 30 days: Filing return but forgetting Aadhaar OTP verification makes ITR invalid, blocks refunds. Set calendar reminder for verification immediately post-submission.

- Incorrect bank account details: IFSC code errors, account number mistakes delay refunds by 3-6 months requiring rectification requests. Pre-validate bank account on e-filing portal before selecting for refund credit.

- Omitting exempt income disclosure: Not reporting PPF interest, agricultural income, dividends below ?5,000 seems harmless but triggers notices as AIS shows these—disclose all income even if exempt, calculate exemption separately.

Professional review catches these errors before submission, saving 4-8 weeks correction cycles and potential penalty exposure for defective returns under Section 139(9).

Latest Updates & Recent Changes (2025-26)

Annual Information Statement (AIS) replaced Form 26AS from AY 2023-24, now including comprehensive data: salary, interest, dividends, capital gains, mutual fund transactions, foreign remittances, cryptocurrency trades, property registrations—360-degree income visibility. Taxpayers must verify AIS accuracy, submit feedback for incorrect entries before filing.

New tax regime made default from AY 2024-25—taxpayers must explicitly opt for old regime to claim Section 80C-80U deductions. New regime offers lower rates (0% up to ?3 lakh, 5% on ?3-7 lakh, capping 30% above ?15 lakh) but eliminates most deductions. Calculator on e-filing portal compares regimes showing optimal choice.

Aadhaar-based verification now instant—earlier 120-day EVC/DSC verification replaced by real-time OTP authentication, enabling same-day filing completion. Updated return facility introduced allowing one revision without restrictions (earlier limited scenarios), valid until December 31 or assessment completion.

Why Choose NiveshKaro & How We Help

NiveshKaro's qualified Chartered Accountants handle ITR filing end-to-end—from document collection to final verification—ensuring maximum legitimate deductions under Sections 80C through 80U, accurate capital gains computation preventing underreporting notices, and optimized regime selection (old vs new) reducing tax liability.

We provide tax planning beyond compliance: restructuring income sources, timing investments for deduction eligibility, advising on advance tax payment schedules avoiding interest, and representing clients during assessment proceedings if notices arise. Visit NiveshKaro.com or call for instant CA consultation—accurate ITR filing with maximum refunds guaranteed within 3 working days!

Disclaimer: NiveshKaro.com provides professional business services via certified CAs, CS, and legal experts—transparent pricing, no hidden costs. Regulations accurate as January 2026, subject to changes. Verify latest rules on official government portals. Visit niveshkaro.com today!

Expert Calling

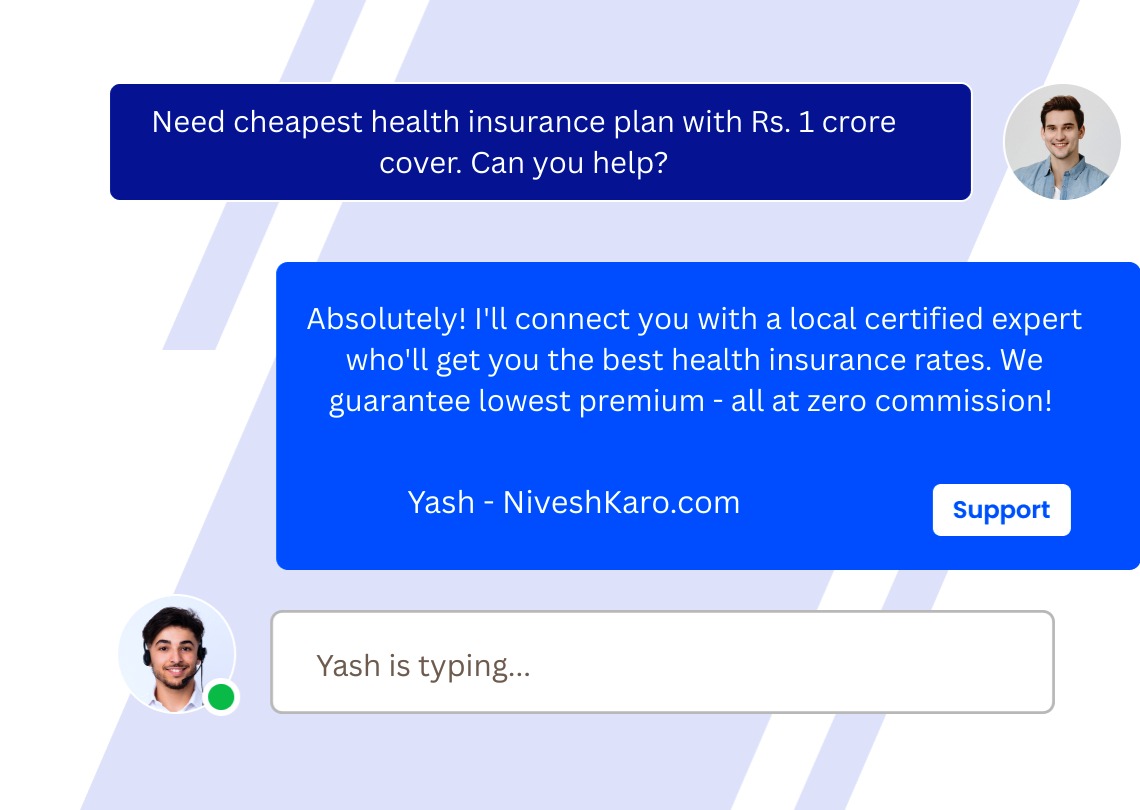

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.