Housing Soc. Maintainance

Can proper society accounting prevent ?5-10 lakh maintenance fund misappropriation and committee disputes? Does professional audit compliance ensure transparent fund management protecting 100+ families' monthly contributions from misuse and legal complications?

What Is Housing Society Accounts & Maintenance & Why It Matters

Housing society accounts involve systematic recording of maintenance collections, operational expenses, and reserve funds under Cooperative Societies Act (state-specific) and Maharashtra Cooperative Societies Act 1960 (model legislation). Registered housing societies must maintain proper books of accounts, conduct annual audits, and file returns with Registrar of Cooperative Societies.

Maintenance accounting tracks monthly collections from members (typically ?2-8 per sq.ft.), expenditure on security salaries, electricity, water charges, lift maintenance, repairs, and sinking fund allocations (10-25% of collections for major repairs). Proper accounting prevents fund misuse, ensures audit compliance, facilitates loan approvals for society projects, and protects committee members from legal liability.

Eligibility & Who Should Apply

All registered cooperative housing societies must maintain accounts and file annual audits regardless of member count. This includes:

- Apartment complexes with 10+ members

- Independent bungalow societies sharing common amenities

- Redevelopment societies managing member contributions

- Commercial-residential mixed societies tracking separate maintenance

Even small 15-20 flat societies require structured accounting—exemptions don't exist based on size, only audit complexity varies.

Key Benefits & Advantages

Professional society accounting delivers:

- Transparency: Monthly financial statements showing income-expenditure preventing member disputes over fund utilization

- Audit compliance: Mandatory annual audits under Section 81 (cooperative law) avoiding ?5,000-25,000 penalties for non-filing

- Legal protection: Proper documentation shields committee members from personal liability in fund misappropriation allegations

- Loan eligibility: Banks require 3-year audited accounts for society loans (lift replacement, building repairs typically ?50 lakh-2 crore)

- Tax benefits: Section 80P exemption on interest income from deposits, investments if accounts properly maintained

- Dispute resolution: Documented transactions resolve conflicts over unauthorized expenses, contractor payments

Societies with clean audit records process member share certificates, NOCs, transfer approvals 50% faster than non-compliant societies facing registrar objections.

Documents Required

- Society registration certificate and bylaws

- Member register with flat numbers, maintenance rates

- Bank statements (current and fixed deposit accounts)

- Cash book, ledger entries for all transactions

- Salary registers for society employees (security, housekeeping)

- Vendor invoices: electricity, water bills, lift AMCs, repair bills

- Receipt books for maintenance collection

- Previous year audit reports

- Committee meeting minutes authorizing major expenses

Step-by-Step Application Process

Establish systematic accounting from day one. Open society bank account in registered name, appoint treasurer from committee maintaining cash book recording daily collections and payments. Prepare monthly accounts summarizing income (maintenance, transfer charges, parking fees, interest) and expenses categorized (salaries, utilities, repairs, administrative costs). Present monthly statements at committee meetings within 15 days of month-end, address member queries transparently.

Annually, engage qualified cooperative auditor before financial year-end (March 31). Provide complete books, bank statements, vouchers for audit examination. Auditor verifies maintenance collection rates against approved budgets, checks unauthorized expenditure, confirms sinking fund allocations (typically 10-25% collections), validates vendor payments against approved contracts. Rectify audit observations within 30 days. Finally, conduct Annual General Meeting (AGM) within 6 months (by September 30), present audited accounts to members for approval, file audit report with Registrar of Cooperative Societies within prescribed timelines (typically 30 days post-AGM) avoiding ?10,000-50,000 late filing penalties.

Fees & Costs Breakdown

- Accounting software: ?5,000-15,000 annually (society-specific solutions like ApnaComplex, MyGate)

- Professional accountant: ?3,000-8,000 monthly (50-200 flats), ?8,000-20,000 (200+ flats)

- Annual audit fees: ?10,000-30,000 (small societies), ?30,000-75,000 (large 300+ unit complexes)

- Registrar filing: NIL to ?500 depending on state

- Late filing penalties: ?5,000-50,000 escalating with delay duration

Compliance & Renewal Requirements

Monthly accounts preparation and committee presentation mandatory. Annual audit compulsory under Section 81—qualified cooperative auditor certification required, not regular chartered accountants unless specifically registered. AGM within 6 months of financial year-end (by September 30) presenting audited statements for member approval.

File audit report with Registrar within 30 days post-AGM—Maharashtra requires Form H filing, other states have specific formats. Maintain 7-year record retention for all vouchers, bank statements, audit reports as per cooperative law and Income Tax Act requirements.

Common Mistakes & How to Avoid Them

- Cash transactions without vouchers: Leads to audit qualifications, member suspicion. Mandate cheque/online payments for all expenses >?5,000.

- Mixing capital and revenue expenses: Major repairs from sinking fund, regular maintenance from monthly collections—improper classification causes fund depletion.

- Delayed audit completion: Missing September AGM deadline attracts penalties. Engage auditors by June ensuring timely completion.

Latest Updates (2025-26)

Model Bye-laws 2024 mandate digital record-keeping—accounting software compliance replacing manual registers in societies with 50+ members. GST registration mandatory for societies with annual turnover >?20 lakh (clubhouse rentals, commercial space leasing counted).

Why Choose NiveshKaro

NiveshKaro's cooperative accounting specialists handle monthly bookkeeping, annual audits, and registrar compliance for housing societies—transparent fund tracking, timely AGM preparation, and legal compliance protecting committee members from personal liability. Visit NiveshKaro.com for professional society account management!

Disclaimer: NiveshKaro.com provides professional business services via certified CAs, CS, and legal experts—transparent pricing, no hidden costs. Regulations accurate as January 2026, subject to changes. Verify latest rules on official government portals. Visit niveshkaro.com today!

Expert Calling

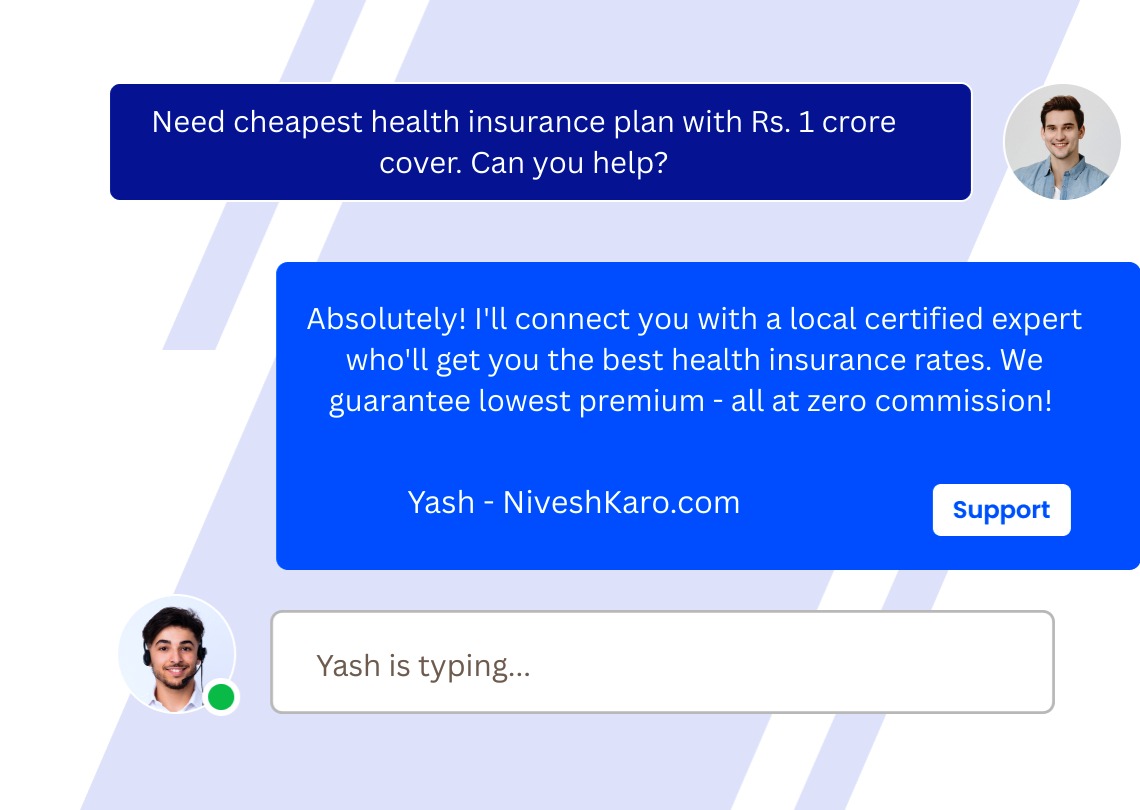

Always Available Support

Real-Time Support When

You Need It

Our expert support team connects you with certified local financial advisors for life insurance, health insurance, car insurance, bike insurance, mutual funds, SIP investments, tax planning, retirement planning, and wealth management services — all at absolutely zero cost with guaranteed best deals.

Instant Call Connect

Submit your information — we call you back within minutes guaranteed.

Call Back Service

Schedule your call — speak with local consultants at your preferred timing.